Cannabis stocks are soaring in 2019. The Horizons Marijuana & Life Sciences ETF (OTC: HMLSF) is up more than 40% in the past month.

So how can you tell if your pot stock is overvalued?

Last week, my team and I compiled pot stocks by their price-to-sales (P/S) ratios.

So this week, we looked at price-to-book (P/B) ratios.

Like most valuation metrics, P/B ratio varies from industry to industry. There's no real magic number.

So you want to focus on companies that trade below their industry averages and be more cautious of those trading above.

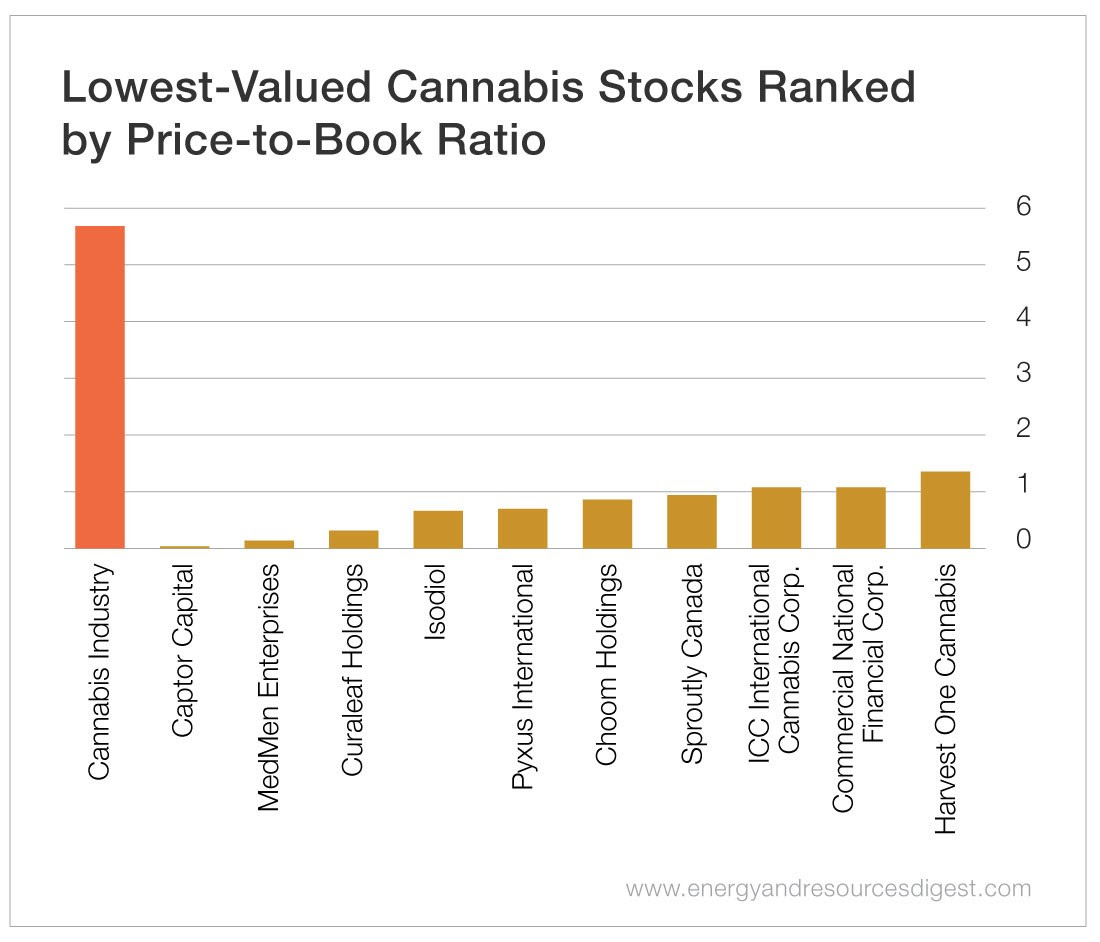

Now, we found the cannabis industry average P/B ratio was 5.6.

Here are the 10 companies trading below that average…

Retire Rich on One Stock! Virginia stock-picking millionaire says forget diversification! Buy one single $3 stock – that trades under a secret name – and you could retire rich. His instructions are here.

There are a lot of dispensary and CBD companies on that list.

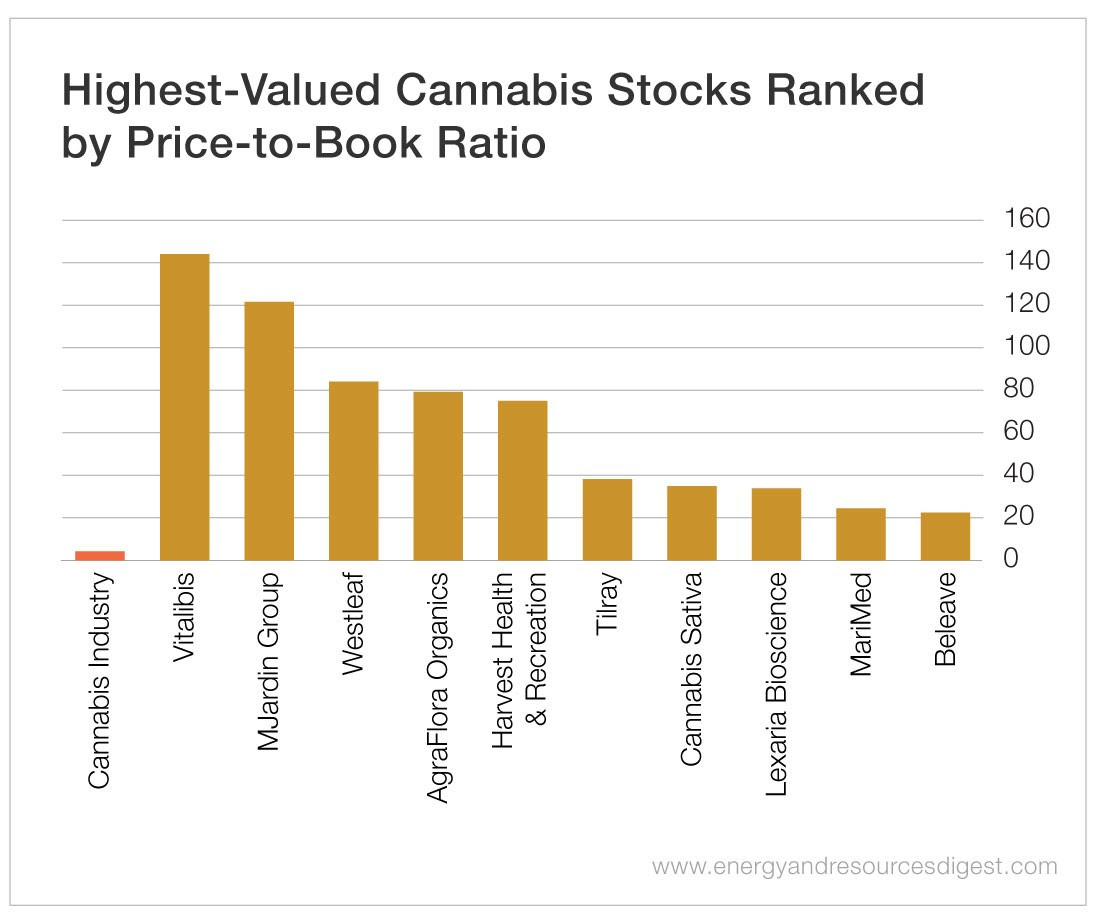

And here are the 10 pot stocks with the highest P/B ratios…

It's worth noting that Vitalibis (OTC: VCBD) was also our highest cannabis stock by P/S last week, and Tilray was on that list as well.

Top 5 Pot Stocks to Watch This Week

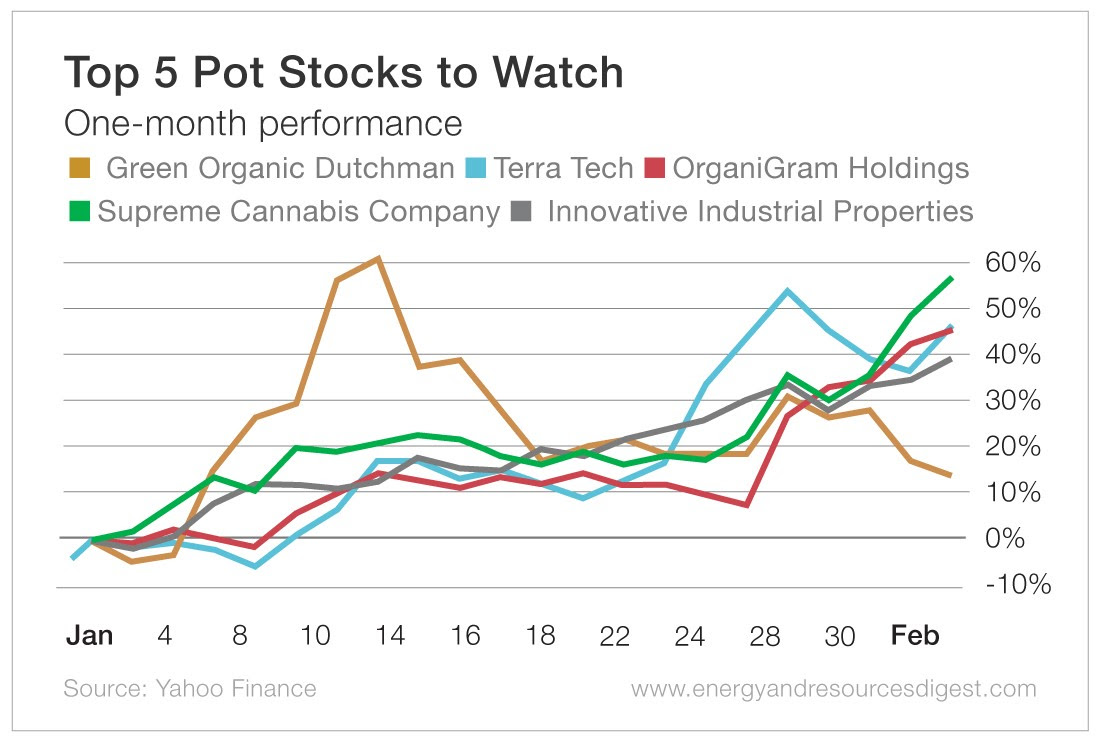

1) The Green Organic Dutchman (OTC: TGODF): This company has made a number of headlines recently. It is weighing a 74 million euro investment in a 34-acre property in Thebes, Greece. This would be a state-of-the-art cultivation facility and would be used for pharmaceutical hemp and cannabis as the company continues its expansion in Europe. Green Organic Dutchman's Danish operations also received a cultivation license recently.

Shares have gained 47.5% [recently]. But they're well below their 52-week high of $7.89.

2) Terra Tech (OTC: TRTC): I've talked about Terra Tech a couple times in recent months. But in January, it had the grand opening of its Blum San Leandro medical cannabis dispensary. This is a historic moment as it's the first medical dispensary to open in the suburb of San Francisco and Oakland.

This dispensary has been six years in the making. So this is some good news for a company that has struggled with falling revenue for a couple of quarters.

Shares of Terra Tech have been butchered over the past year, falling more than 83%. But they've gained more than 18% [recently]. Though they're still light-years away from their 52-week high of $5.74.

3) Supreme Cannabis (OTC: SPRWF; TSX: FIRE): The Canadian producer is moving up from TSX Venture [to the Toronto Stock Exchange]. Its 7Acres label received “Brand of the Year” in 2018 at the Canadian Cannabis Awards. And Supreme's license space at its 7Acres facility was just increased to 120,000 square feet. This will increase its growing capacity from 13,300 kilograms to 17,500 kilograms.

Shares of Supreme are on FIRE… up more than 57% in the past month. And they're closing in on their 52-week high of $2.04.

4) OrganiGram Holdings (OTC: OGRMF): Speaking of new highs, one of my favorite Canadian producers, OrganiGram, notched a major milestone last week: It produced its 1 millionth cannabis pre-roll.

On top of that, the company announced its first quarter revenue surged 419% year over year to $9.39 million. This was also a 287% sequential increase from its fourth quarter of 2018.

Even better, its all-in cost per gram declined from $0.63 a year ago to $0.57. Got to love rising revenue and falling costs…

Shares of OrganiGram are up more than 45% in the past month. And they're inching closer to their 52-week high of $6.68, set back in September.

5) Innovative Industrial Properties (NYSE: IIPR): This real estate investment trust is setting new 52-week highs.

It specializes in cannabis facilities, and its share price has been on a tear over the past month, gaining more than 40%.

I've talked about it here in the past as a safety play for the industry. It offers a 2.26% dividend yield – a rarity among pot stocks. So when investors are spooked and rushing for safety, Innovative Industrial Properties wins. And when the cannabis industry takes off, it sails high as well.

It could also be an under-the-radar winner in the New York legalization move. It currently has two leased properties in the state but could seek out more if recreational legalization was passed.

The S&P 500 and Dow Jones Industrial Average enjoyed their best January since 1987, gaining more than 7% each last month.

These five pot stocks topped that performance several times over…

I am new at this. I am 80 years lady. If i call a broker whst do i tell him i want to buy. Can you give me the stocks you would buy. Thank you