This story was originally published here.

Microsoft stock has been one of the biggest winners so far this year. In fact, shares are up nearly 37% year-to-date, and more than 55% from their March selloff lows. But, that’s no surprise.

Why?

Well, firstly, the novel coronavirus has wound up being a near-term tailwind for the company. And, secondly, the pandemic has accelerated cloud computing megatrends already in motion before the outbreak.

Add in the company’s strong fundamentals, and it’s clear why this stock’s been a winner. Sure, you may be thinking shares are topping out. That is to say, today’s prices (near all-time highs) isn’t the best entry point.

Yet, there’s no reason for concern with MSFT stock at today’s prices.

How so? Pandemic tailwinds will continue to drive near-term results, and the cloud megatrend provides long-term runway. To top it all off, the company’s deep economic moat and strong balance sheet make this a high quality stock for both agressive and conservative investors.

Put it all together, and there’s good reason to make this a core holding. Let me explain…

Editor's Note: Click here to keep reading.

Electric cars are taking over

Dear Reader,

A new type of battery is pushing everything we thought we knew about energy storage to the limits.

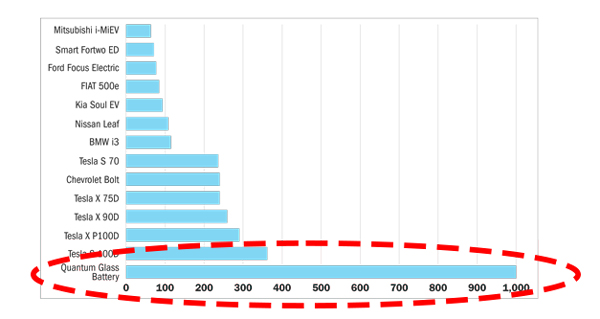

According to automotive insiders, consumers will soon be able to go 1,000 miles on a single charge.

Think about that for a moment…

That’s nearly TRIPLE the distance of the best-performing electric cars on the market right now — and more than 8 TIMES farther than the average electric car…

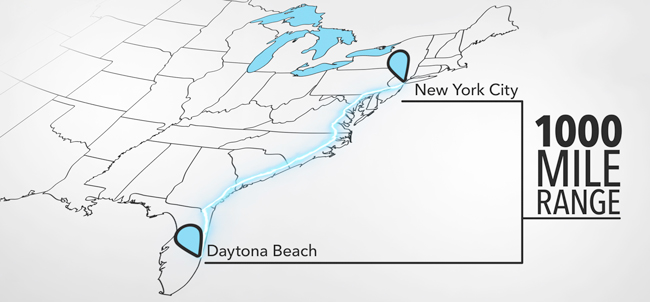

That means you could drive from New York City all the way down to Daytona Beach, Florida, without stopping!

A 1,000-mile range clobbers even the most fuel-efficient gas vehicles on the road today!

In short, this tech is about to change EVERYTHING.

When you see this live-action demo, you’ll understand why.

Here’s the best part:

At the heart of this new technology is one company — 1/1,000th the size of GM.

If you want to get in on the electric car revolution, this is easily the best way to do it.

Click here to see the full story.

Sincerely,

Matt McCall

Senior Investment Strategist, InvestorPlace