The Dividend Aristocrats are a select group of 65 S&P 500 stocks with 25+ years of consecutive dividend increases.

They are the ‘best of the best’ dividend growth stocks. The Dividend Aristocrats have a long history of outperforming the market.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

There are currently 65 Dividend Aristocrats. Today we're going to analyze the top seven Dividend Aristocrats you can buy in 2022.

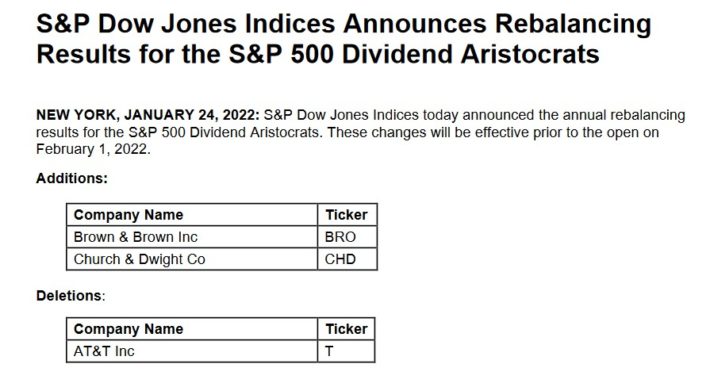

Note: On January 24th, 2022 Brown & Brown (BRO) and Church & Dwight (CHD) were added to the Dividend Aristocrats Index, while AT&T (T) was removed. Also, People’s United (PBCT) was acquired, leaving 65 Dividend Aristocrats.

You can see detailed analysis on all 65 further below in this article, in our Dividend Aristocrats In Focus Series. Analysis includes valuation, growth, and competitive advantage(s).

Performance Of The Dividend Aristocrats

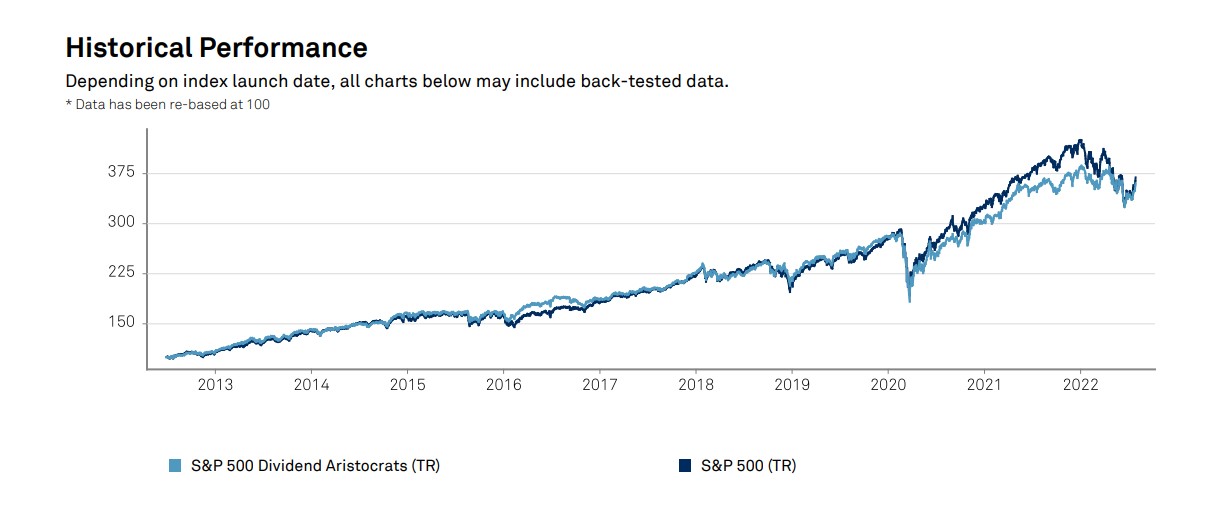

In July 2022, the Dividend Aristocrats, as measured by the Dividend Aristocrats ETF (NOBL), registered a positive 6.6% return. It underperformed the SPDR S&P 500 ETF (SPY) for the month.

- NOBL generated total returns of 6.6% in July 2022

- SPY generated total returns of 9.2% in July 2022

Short-term performance is mostly noise. Performance should be measured over a minimum of 3 years, and preferably longer periods of time.

The Dividend Aristocrats Index has nearly matched the performance of the broader market index over the last decade, with a 13.5% total annual return for the Dividend Aristocrats versus 13.8% for the S&P 500 Index.

The Dividend Aristocrats have exhibited lower risk than the benchmark, as measured by standard deviation.

Higher total returns with lower volatility is the ‘holy grail’ of investing. It is worth exploring the characteristics of the Dividend Aristocrats in detail to determine why they have performed so well.

Note that a good portion of the outperformance relative to the S&P 500 comes during recessions (2000 – 2002, 2008). Dividend Aristocrats have historically seen smaller drawdowns during recessions versus the S&P 500. This makes holding through recessions that much easier. Case-in-point: In 2008 the Dividend Aristocrats Index declined 22%. That same year, the S&P 500 declined 38%.

Great businesses with strong competitive advantages tend to be able to generate stronger cash flows during recessions. This allows them to gain market share while weaker businesses fight to stay alive.

The Dividend Aristocrats Index has beaten the market over the last 28 years…

We believe dividend paying stocks outperform non-dividend paying stocks for three reasons:

- A company that pays dividends is likely to be generating earnings or cash flows so that it can pay dividends to shareholders. This excludes ‘pre-earnings’ start-ups and failing businesses. In short, it excludes the riskiest stocks.

- A business that pays consistent dividends must be more selective with the growth projects it takes on because a portion of its cash flows are being paid out as dividends. Scrutinizing over capital allocation decisions likely adds to shareholder value.

- Stocks that pay dividends are willing to reward shareholders with cash payments. This is a sign that management is shareholder friendly.

In our view, Dividend Aristocrats have historically outperformed the market and other dividend paying stocks because they are, on average, higher-quality businesses.

A high-quality business should outperform a mediocre business over a long period of time, all other things being equal.

For a business to increase its dividends for 25+ consecutive years, it must have or at least had in the very recent past a strong competitive advantage.

Sector Overview

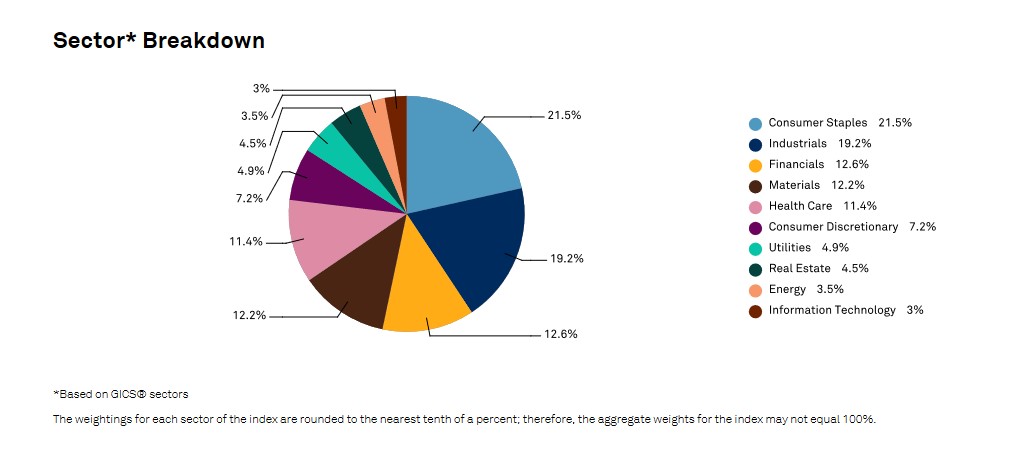

A sector breakdown of the Dividend Aristocrats Index is shown below:

The top 2 sectors by weight in the Dividend Aristocrats are Industrials and Consumer Staples. The Dividend Aristocrats Index is tilted toward Consumer Staples and Industrials relative to the S&P 500.

These 2 sectors make up over 40% of the Dividend Aristocrats Index, but less than 20% of the S&P 500.

The Dividend Aristocrats Index is also significantly underweight the Information Technology sector, with a 3% allocation compared with over 20% allocation within the S&P 500.

The Dividend Aristocrat Index is filled with stable ‘old economy’ blue chip consumer products businesses and manufacturers; the 3M’s (MMM), Coca-Cola’s (KO), and Johnson & Johnson’s (JNJ) of the investing world.

These ‘boring’ businesses aren’t likely to generate 20%+ earnings-per-share growth, but they also are very unlikely to see large earnings drawdowns as well.

The Top 7 Dividend Aristocrats Now

Analysis on our top 7 Dividend Aristocrats is below. These rankings are based on 5 year forward expected total return estimates from the Sure Analysis Research Database.

Dividend Aristocrat #7: Cincinnati Financial (CINF)

5-year Expected Annual Returns: 11.4%

Cincinnati Financial is an insurance stock. It offers business, home, auto insurance, and financial products, including life insurance, annuities, property, and casualty insurance.

As an insurance company, Cincinnati Financial makes money in two ways. It earns income from premiums on policies written and by investing its float, or the large sum of money consisting of the time value between the premium income and insurance claims.

On April 28, 2022, Cincinnati Financial reported the first quarter results for Fiscal Year (FY)2022. Total revenues were $1,215 million for the quarter compared to $2,227million in 1Q2021. Thus, revenues were down (45)% year over year. Earned premiums were up 9% year over year.

On a non-GAAP operating income basis, the company made $253 million for the quarter, up $31 million or 14% compared to the first quarter of 2021. For the quarter, non-GAAP operating income is up 15%, from $1.37 per share in 1Q2021 to $1.58 per share. The company book value increased 9% year over year to $75.43 but is down $6.29 since year-end.

The first quarter was the company’s highest-ever single quarter of new business written premiums, reaching $244 million. The company plans to continue to look for opportunities to appoint new agents. So far this year, the company appointed 51 agencies to offer its property-casualty products.

Also, on January 28, 2022, the company increased its dividend by 9.5% to $0.69 per share per quarter. This makes it 62 years of dividend increases.

We expect 6% annual EPS growth through 2027. In addition, the stock has a current dividend yield of 2.7%. Lastly, the stock appears to be undervalued. Total returns are estimated at 11.4% per year over the next five years.

Dividend Aristocrat #6: Target Corporation (TGT)

5-year Expected Annual Returns: 11.9%

Target was founded in 1902 and after a failed bid to expand into Canada, has operations solely in the U.S. market. Its business consists of about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s burgeoning e-commerce business.

Target reported first-quarter results on May 18th. Quarterly revenue of $25.17 billion beat analyst estimates by $688 million, but earnings-per-share of $2.19 missed estimates by $0.87. Cost inflation led to the disappointing EPS figure.

We see continued comparable sales growth as driving results, along with a small measure of margin expansion, and a tailwind from the buyback. Target’s digital efforts are also working extremely nicely, and the company’s small-format stores are performing very well, opening a new avenue of growth for the company in the coming years. The remaining buyback authorization should be good for a significant tailwind to earnings-per-share in the coming years.

We expect 8% annual EPS growth through 2027. In addition, the stock has a current dividend yield of 2.6%. Lastly, the stock has a 2022 P/E of 15.6, below our fair value P/E of 17. Total returns are estimated at 11.9% per year over the next five years.

Dividend Aristocrat #5: Pentair (PNR)

5-year Expected Annual Returns: 12.8%

Pentair operates as a pure–play water solutions company with 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies. Pentair was founded in 1966. Pentair has increased its dividend for more than four decades in a row, when adjusted for spin–offs.

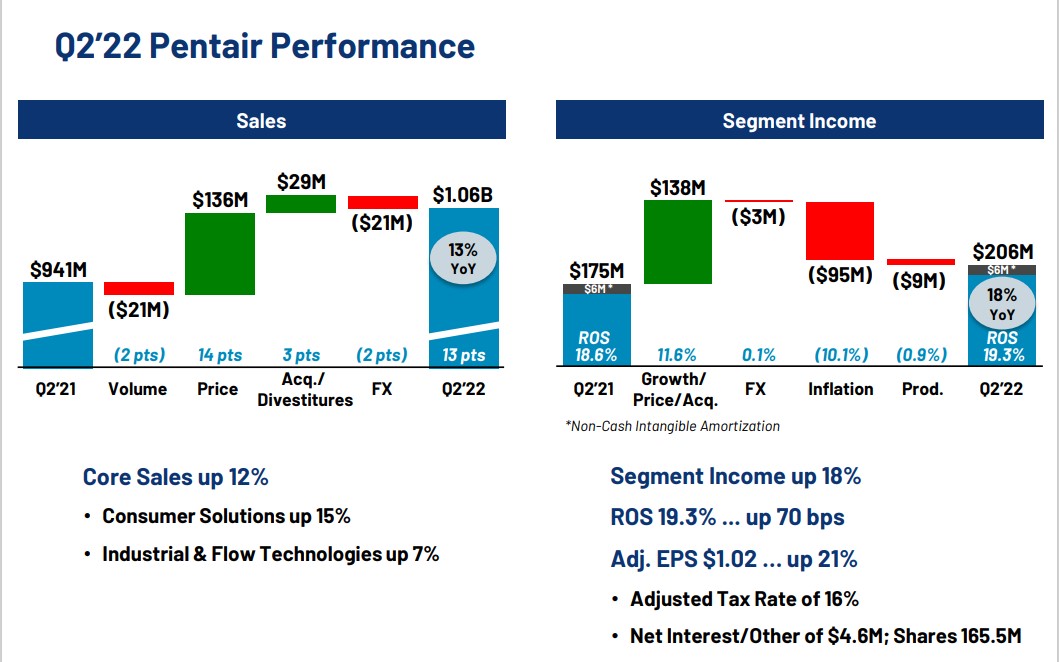

Pentair reported its second quarter earnings results on July 26. The company was able to generate revenues of $1.02 billion during the quarter, which was 8% more than the company’s revenues during the previous year’s quarter, a result that missed estimates slightly.

Core sales, which excludes the impact of currency rate movements, acquisitions, and dispossessions, were up 12% year over year, which was on par with the revenue growth rate during the previous quarter, and which reflects healthy business growth momentum.

Pentair recorded earnings-per-share of $1.02 for the second quarter, which was up by a compelling 21% year over year. Pentair’s earnings-per-share beat the analyst consensus by $0.02. Pentair reiterated its guidance for the current year during the earnings report.

For fiscal 2022, Pentair is forecasting earnings-per-share in a range of $3.70 to $3.75, which indicates solid earnings-per-share growth of around 12% compared to the $3.32 the company earned in 2021. 2022 will also be a new record year for the company, adjusted for the nVent spinoff, according to management.

Total returns are expected to reach 12.8% over the next five years.

Dividend Aristocrat #4: Walgreens Boots Alliance (WBA)

5-year Expected Annual Returns: 13.2%

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 325,000 people and has more than 13,000 stores.

On June 30th, 2022, Walgreens reported Q3 results for the period ending May 31st, 2022. Sales from continuing operations dipped -4% and adjusted earnings-per-share decreased -30% over the prior year’s quarter, from $1.37 to $0.96, mostly due to peak COVID-19 vaccinations in the prior year’s period.

Earnings-per-share exceeded analysts’ consensus by $0.03. The company has beaten analysts’ estimates for 8 consecutive quarters.

Walgreens reiterated its guidance for low-single digit growth of its annual earnings-per-share.

We expect 3% annual EPS growth over the next five years. In addition, the stock has a 4.8% dividend yield. We also view the stock as undervalued, leading to total expected returns of 13.2% per year.

Dividend Aristocrat #3: Lowe’s Companies (LOW)

5-year Expected Annual Returns: 14.1%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 2,200 home improvement and hardware stores in the U.S. and Canada.

Lowe’s reported first quarter 2022 results on May 18th. Total sales for the first quarter came in at $23.7 billion compared to $24.4 billion in the same quarter a year ago. Comparable sales decreased 4%, while U.S. home improvement comparable sales decreased 3.8%.

Of note, pro customer sales rose 20% year-over-year. Net earnings of $2.3 billion was in-line with results from Q1 2021. Diluted earnings per share of $3.51 was a 9.3% increase from $3.21 a year earlier.

The company repurchased 19 million shares in the first quarter for $4.1 billion. Additionally, they paid out $537 million in dividends. The company remains in a strong liquidity position with $3.4 billion of cash and cash equivalents.

The company provided a fiscal 2022 outlook and believes they can achieve diluted EPS in the range of $13.10 to $13.60 on total sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion worth of common shares in 2022.

The combination of multiple expansion, 6% expected EPS growth and the 1.8% dividend yield lead to total expected returns of 14.1% per year.

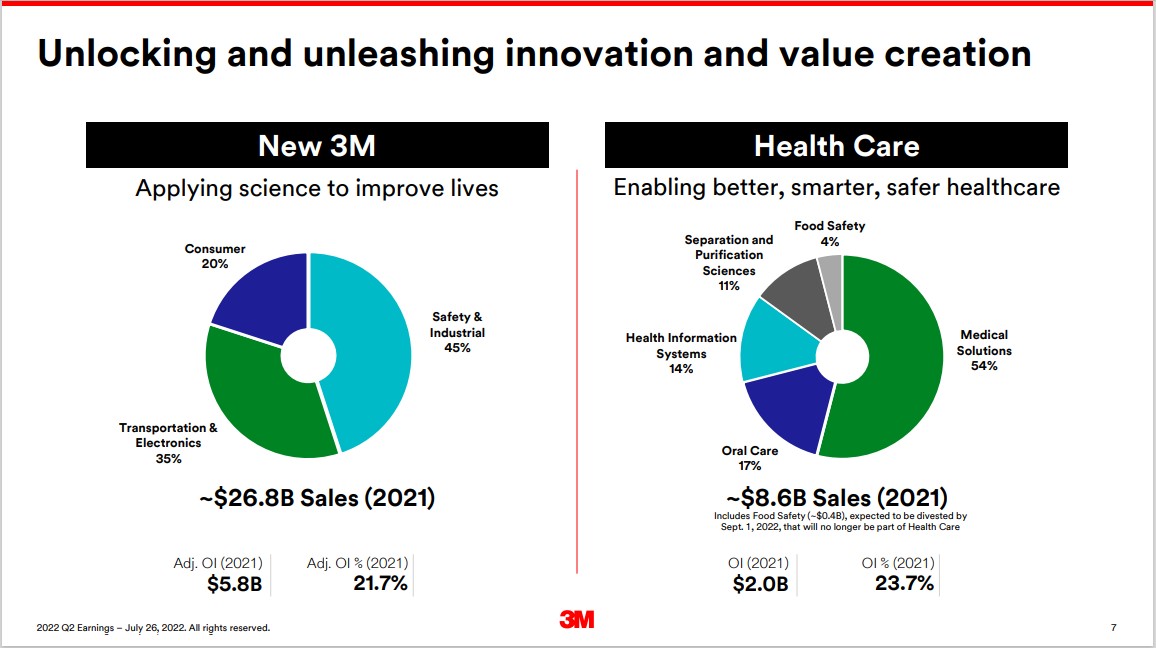

Dividend Aristocrat #2: 3M Company (MMM)

5-year Expected Annual Returns: 14.9%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

On July 26th, 2022, 3M reported second quarter earnings results for the period ending June 30th, 2022. Revenue decreased 2.8% to $8.7 billion, but was in-line with expectations. Adjusted earnings-per-share of $2.48 compared to $2.59 in the prior year, but was $0.04 above estimates. Organic growth for the quarter was 1% as a stronger U.S. dollar weighed.

The company also announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

3M provided an updated outlook for 2022, with the company now expecting adjusted earnings-per-share of $10.30 to $10.80 for the year, down from $10.75 to $11.25 previously.

Dividend Aristocrat #1: V.F. Corporation (VFC)

5-year Expected Annual Returns: 17.7%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

In late July, V.F. Corp reported (7/28/22) financial results for the fiscal 2023 first quarter. Revenue of $2.26 billion rose 3.2% year over year and beat analyst estimates by $20 million. The North Face brand led the way with 37% currency-neutral revenue growth in the quarter.

However, inflation took its toll on margins and profits. Gross margin of 53.9% for the quarter declined 260 basis points, while operating margin of 2.8% declined 640 basis points. As a result, adjusted EPS declined 68% to $0.09 per share.

Adjusted earnings-per-share grew 67%, from $0.27 to $0.45, but missed analysts’ consensus by $0.02. For the new fiscal year, V.F. Corp expects revenue growth of at least 7% and adjusted earnings-per-share of $3.30 to $3.40.

We expect 7% annual EPS growth over the next five years. VFC stock also has a dividend yield of 4.5%. Annual returns from an expanding P/E multiple are estimated at ~6.2%, equaling total expected annual returns of 17.7% through 2027.

Frequently Asked Questions

This section will address some of most common questions investors have regarding the Dividend Aristocrats.

1. What is the highest-paying Dividend Aristocrat?

Answer: IBM currently yields 5.0%.

2. What is the difference between the Dividend Aristocrats and the Dividend Kings?

Answer: The Dividend Aristocrats must be constituents of the S&P 500 Index, have raised their dividends for at least 25 consecutive years, and satisfy a number of liquidity requirements. The Dividend Kings only need to have raised their dividends for at least 50 consecutive years.

3. Is there an ETF that tracks the Dividend Aristocrats?

Answer: Yes, the Dividend Aristocrats ETF (NOBL) is an exchange-traded fund that specifically holds the Dividend Aristocrats.

4. What is the difference between the Dividend Aristocrats and the Dividend Champions?

Answer: The Dividend Aristocrats and Dividend Champions share one requirement, which is that a company must have raised its dividend for at least 25 consecutive years.

But like the Dividend Kings, the Dividend Champions do not need to be in the S&P 500 Index, nor satisfy the various liquidity requirements.

5. Which Dividend Aristocrat has the longest active streak of annual dividend increases?

Currently, there are 4 Dividend Aristocrats tied at 66 years: Procter & Gamble, Genuine Parts, 3M Company, and Dover Corporation.

6. What is the average dividend yield of the Dividend Aristocrats?

Right now, the average dividend yield of the 65 Dividend Aristocrats is 2.4%.

7. Are the Dividend Aristocrats safe investments?

While there are never any guarantees when it comes to the stock market, we believe the Dividend Aristocrats are among the safest dividend stocks when it comes to the sustainability of their dividend payouts.

The Dividend Aristocrats have durable competitive advantages that allow them to raise their dividends each year, even during a recession.

Final Thoughts

So, where should you invest $100 right now?

Our award-winning analyst team just revealed what they believe are the 5 top under-the-radar income stocks for investors to buy right now…