Bill H.R. 6321, while seemingly innocent, could have major implications for main-Street Americans. Hidden away is the introduction of the “Digital Dollar” which could completely upend our financial institutions, and be devastating for retirees, savers, and… well just about anyone. So, let’s cover what it is, how it could affect you, and the best moves you can make right now to prepare for it.

What Is The “Digital Dollar”

The “Digital Dollar” is referencing the US dollar becoming a CBDC, or central bank digital currency, which is essentially a digital form of a country’s physical fiat currency. You may think this sounds a lot like crypto, and while it stems from cryptocurrencies and blockchain technology, it is not a cryptocurrency. CBDCs like the “Digital Dollar” are controlled by a central bank which would be able to be regulated by the U.S. government. In theory, switching to this system could eliminate funds transfer waiting periods, cut fees, and allow those without bank accounts to move money across borders.

To boil it down, instead of the dollar being a physical bill, it would become a digital token.

Some believe this could be a step towards ending physical currency altogether. There are already major companies leaning into the new “Digital Dollar” initiative. McDonald’s, Disney, Shake Shack, Starbucks, Panera, Walmart, and Whole Foods – have already beta-tested the first steps for what’s coming. One of Bill Gate’s lesser Known initiative the “Better Than Cash Alliance” is increasingly making the push for this transition. And from their own website, they want “To accelerate the global transition from cash to digital payments.”

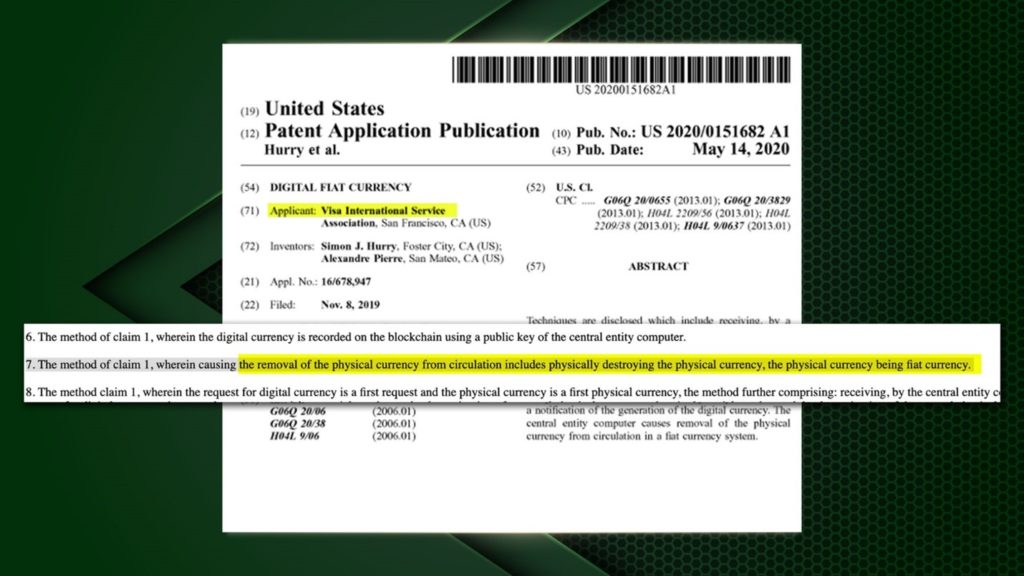

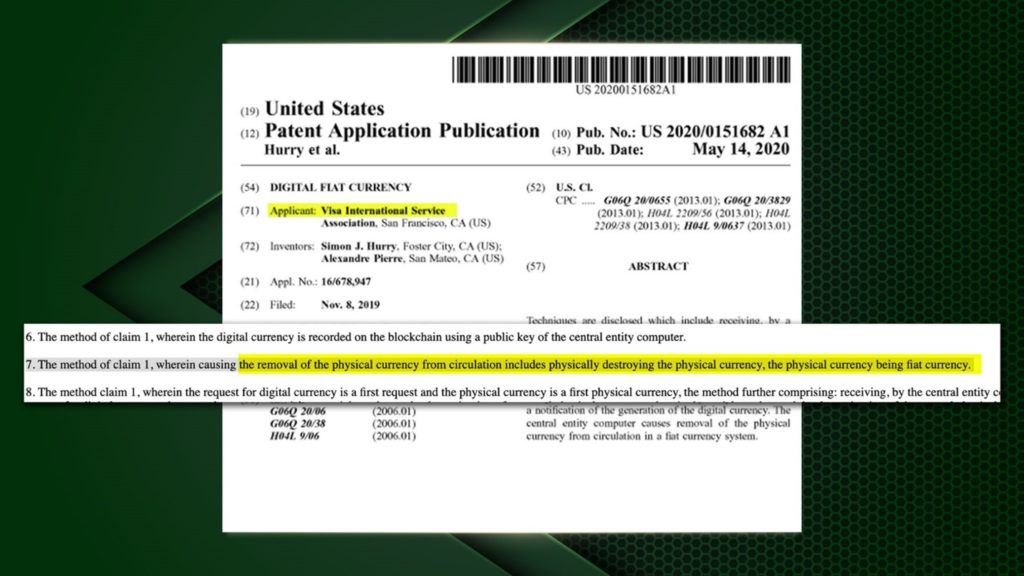

This transition is already being planned out. Take a look at this patent from Visa:

As this new initiative takes place, they are planning to remove and physically destroy dollar bills in favor of digital currency.

To recap, the digital dollar is an electronic alternative to our physical fiat currency with support from congress, the white house, and major corporate players. With some already planning out the transition. But, what the “digital dollar” is, isn’t as important as…

How Could It Affect The Everyday American

First off, this could mean that eventually, the cash in someone’s pocket would be less versatile than it was 10 years ago. If companies, like the ones stated above, make this transition, then you may be out of luck trying to spend your cash and major stores, restaurants, cafes…etc. We already saw a glimpse of what that could be like back in 2020.

While you may think this is simply an inconvenience or even a non-issue, it brings up the second concern: privacy. The “digital dollar” would likely be operated by the government, meaning they could potentially have the ability to monitor transactions, halt them, or even confiscate your money[v]. Essentially, it could give the U.S. Government unprecedented access to the financial information of anyone using the “digital dollar”.

Here’s a quote that sums it up from the bitcoin policy institute “If the government controls the ledger, then there is a risk that it will monitor those transactions without going through the proper legal channels because it’s not taking information from someone else”.

Finally, and perhaps most importantly, some experts believe it could increase inflation, meaning your savings would decrease in value more than it already is due to the current inflation crisis. For Retiree's and Savers, this could be even more devastating. So…

What We Recommend Doing about it

As with all major changes, there are winners and losers. In order to fully understand how to best combat the woes of transitioning to the digital dollar, we're giving access to a video investigation from our friends at paradigm press, that will go further in detail about what we believe you should do.