The Public Cannabis Company Revenue Tracker, managed by New Cannabis Ventures, ranks the top revenue producing cannabis stocks that generate industry sales of more than US$5.0 million per quarter. This data-driven, fact-based tracker will continually update based on new financial filings so that readers can stay up to date. Companies must file with the SEC or SEDAR to be considered for inclusion. Please note that we raised the minimum quarterly revenue in May from US$2.5 million.

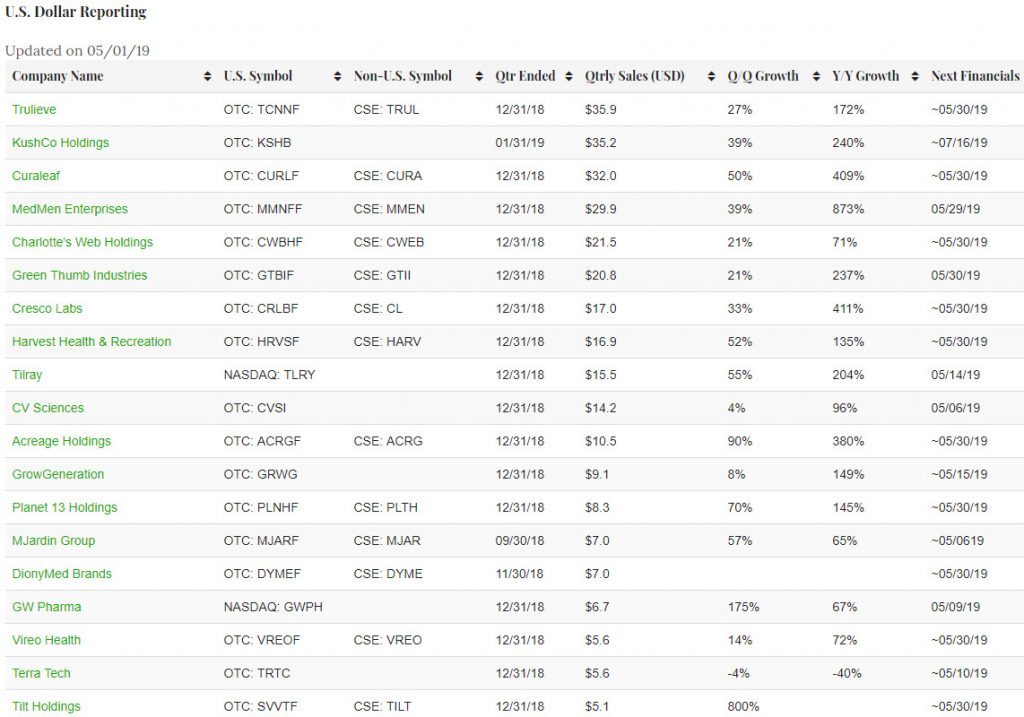

As a result of our raising the minimum cannabis-related revenue for consideration, 31 companies currently qualify for inclusion, with 19 filing in U.S dollars and 12 in the Canadian currency. Since our last report in mid-April, we have added TILT Holdings (CSE: TILT) (OTC: SVVTF) and Vireo Health (CSE: VREO) (OTC: VREOF), both of which report in U.S. dollars. With the upcoming filing season, we expect some companies that dropped off could rejoin, and we continue to see new companies go public, like Greenlane (NASDAQ: GNLN), which we expect to include once quarterly information is available.

Several of the largest companies reported in the back half of April, and we have noted the additions as well. One trend we have observed is that most of the companies are now providing pro forma revenue as well, which is an attempt to more accurately portray the operations by taking into account the results of closed and pending acquisitions as the multi-state operator (MSO) space rapidly consolidates. Our rankings include only actual reported revenue.

U.S Dollar Reporting – Public Cannabis Company Revenue Tracker

Of the companies that report in Canadian dollars and that generated the equivalent of more than US$10 million, Organigram(TSXV: OGI) (OTC: OGRMF), Aphria (TSX: APHA) (NYSE: APHA) and National Access Cannabis (TSXV: META) (OTC: NACNF) reported financials in the back part of April. The Organigram report for its fiscal Q2 allowed it to advance ahead of Aphria, which reported its fiscal Q3. Note that the overall revenue generated by Aphria, which is boosted by non-cannabis revenue, was much higher. Its cannabis-related revenue actually declined from its Q2 levels. The vast majority of the revenue from National Access is related to its retail cannabis stores.

Visit the Public Cannabis Company Revenue Tracker to track and explore the complete list of qualifying companies.

Full story at New Cannabis Ventures