Not many trading systems have led to winning trades 95% of the time since 1991.

And not many have beaten their benchmark over three-, six-, and 12-month periods, on average.

But the incredibly “dumb” system I'll share with you today has done exactly that. Let me explain…

This is a simple system for buying real estate stocks – in particular, real estate investment trusts (“REITs”).

I write a lot about stocks… But I personally have more of my financial assets tied up in Florida real estate than in the stock market.

That's turned out to be a good trade… Property prices in Florida have soared since 2011. And I've more than doubled my money in a few properties.

One simple indicator says there's more upside ahead in real estate investments…

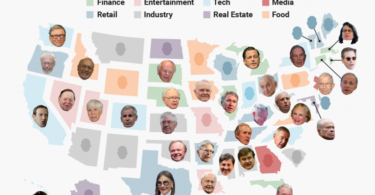

The main U.S. real estate stock index recently broke out to new all-time highs. And history says it could rise 13% over the next year.

REITs are simple at their core. They own real estate – like apartments, office buildings, or single-family homes – and rent the property out for income.

One great thing about REITs is they pay no federal income tax as long as they pass on at least 90% of their income to shareholders. That makes them high-yield investments… exactly what a lot of folks want right now.

Lately, real estate stocks have been soaring along with the U.S. stock market. The Dow Jones REIT Index recently broke out to a new all-time high.

You can see the major breakout in the chart right here…