This story was originally published here.

Artificial intelligence is one of those catchy phrases that continues to grab investors’ attention. Like 5G, it tugs on the sleeves of those looking to get in on cutting-edge technology. While it is a very important sector of technology, investors need to be wary of hype and focus on reality before buying AI stocks.

Take, for example, International Business Machines (NYSE:IBM). IBM has been on the front line of AI with its Watson-branded products and services. Sure, it did a bang up job on Jeopardy and it partners with dozens of companies. But for IBM shareholders, Watson is not a portfolio favorite.

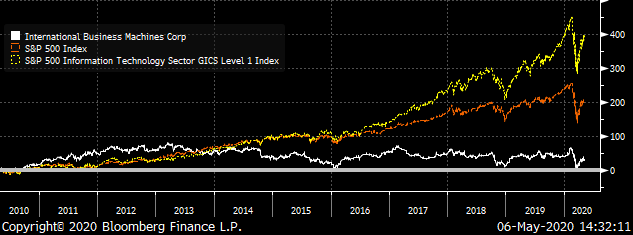

Over the past five years, IBM has lost 28.7% in price compared to the S&P 500’s gain of 37.5% and the S&P Information Technology Index’s gain of 130%. And over the past 10 years, IBM’s AI leadership has generated a shareholder loss of 3.4%.

Source: Chart by Bloomberg

IBM (White), S&P 500 (Red) & S&P 500 Information Technology (Gold) Indexes Total Return

But AI is more than just a party trick like Watson. AI brings algorithms into computers. These algorithms then take internal and external data, and in turn process decisions behind all sorts of products and services. Think for example something as simple as targeted ads. Data is gathered and processed while you simply shop online.

But AI can go much further. Think, of course, of autonomous vehicles. AI takes all sorts of input data and the central processor makes calls to how the vehicle moves — and at what speed and direction.

Or in medicine, AI brings quicker analysis of symptoms, diagnostic data and tests.

And the list goes on.

So then what do I bring to the table as a human? I have found ten AI stocks that aren’t just companies using AI. These are companies to own and follow for years — complete with dividends along the way…

Editor's Note: To see all 10 stocks and keep reading, click here.

#1 5G Stock To Buy Now

There’s a lot of hype surrounding 5G these days…

And for good reason. It’s a breakthrough technology that’s going to change the world and make early investors a fortune.

But investing legend Louis Navellier says there’s only one 5G stock you should be paying attention to right now.

This is coming from the analyst who…

- Found Microsoft when it was trading for 39 cents.

- Cisco at 50 cents.

- Qualcomm at $2.45.

- Adobe at $1.91.

- Apple when the legendary software company was trading for $1.38.

- Amazon when it was just a $46 stock (today it’s over $1,885).

And MarketWatch said he was “the advisor who recommended Google before anyone else.”

Now Louis’s pounding the table on a 5G stock he recently uncovered.

He’s put together a presentation with the full details which you can view right here.