Gold continued its trek lower last week, the price steadying around $1,220 an ounce on Tuesday following Federal Reserve Chair Jerome Powell’s congressional testimony. Powell commented that he thought the U.S. was on course for continued steady growth, supporting his expectation of a rate hike every three months. These comments sent the dollar up and gold down.

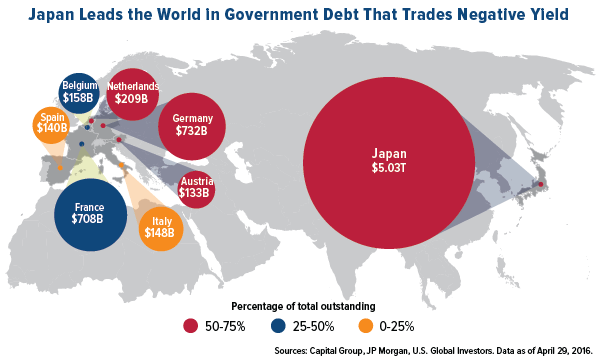

Despite this movement, I’m amazed that gold is holding up so well, particularly when you compare real interest rates in the U.S., Japan and the European Union.

In addition to these price moves, we’ve seen suppression and manipulation in the gold market in recent years. This is a topic I discussed last week in our webcast, cohosted by Randy Smallwood, CEO of Wheaton Precious Metals.

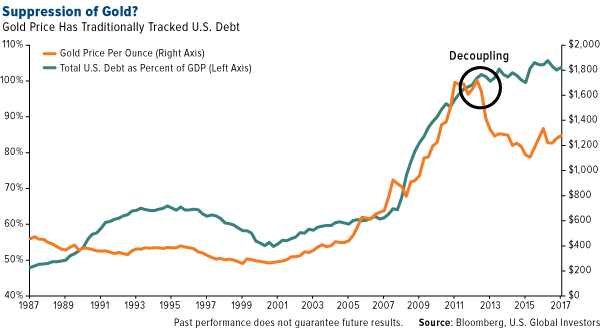

What do I mean by “gold suppression”? Historically, the price of gold has tracked U.S. debt, but as you can see in the chart below, that seems no longer to be the case.

The question, then, is not whether gold is actively being suppressed, but to what extent and by whom. Traders working at some big banks—including UBS, Deutsche Bank and HSBC—have already been charged for manipulating the price of precious metals futures contracts and fined as much as $30 million by the Commodity Futures Trading Commission (CFTC).

However, I’m skeptical that this has resolved the issue. In the past several years, gold has traded down in the week prior to China’s Golden Week, when markets are closed. As much as $2.25 billion of the yellow metal was dumped in the futures market in October 2016, as someone clearly sought to take advantage of the fact that markets were closed for the week in the world’s largest buyer of gold.

During the webcast, Randy Smallwood thoughtfully pointed out that the deliberate suppression of prices can't go on forever. I agree, and believe that precious metals such as gold and silver are significantly undervalued right now.

So what should investors be paying attention to?

The Magic Behind the Math

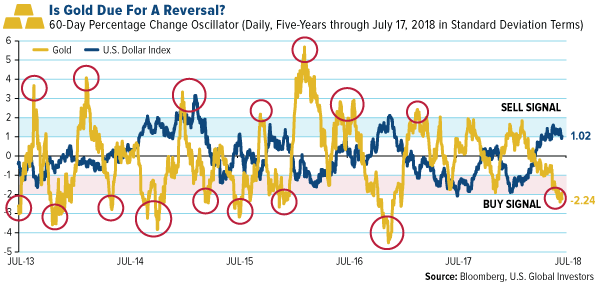

Using an oscillator chart, let's compare the U.S. dollar to gold. I believe oscillators are vital to identifying the optimal time to buy or sell, and right now it appears that the greenback is overbought while gold is oversold.

Looking back over five years of data, we've discovered that, historically, when gold exceeded two standard deviations above the mean, the commodity fell 51 percent of the time in the following three months.

In contrast, when gold prices exceeded two standard deviations below the mean, it rose 77 percent of the time in the following three months. This is because gold is undervalued at this level.

Buying the laggards when the time is right could enable you to participate in a potential rally—and right now, that rally could be in gold, currently down 2.24 standard deviations.

Understanding this kind of math is almost like being adept at counting cards. In the 2008 film 21, an MIT professor helps six students become experts at card counting. The story, based on true events, shows how these students end up taking Vegas casinos for millions in winnings by following their professor’s teachings. Of course, there’s no way I can promise such an extraordinary outcome in your investments, but I do think there’s something to be said for the magic behind the math.

Gold isn’t the only commodity that might be due for a reversal…