This story was originally published here.

In recent weeks a change has been happening on U.S. roadways.

Fewer cars.

Nearly 97% of Americans are under the COVID-19 stay-at-home order. I know I’m saving on gas and working on about three weeks to the gallon!

And there’s one major industry that’s also getting an unexpected boost from this: the auto insurance industry.

With fewer drivers on the road, several auto insurance companies are reporting massive declines in claims.

Major insurers like Allstate Corp. reportedly pays out over $1 billion per month in auto insurance claims.

Because claims have now dropped by over 80% per month, it’s passing some of the savings to customers.

Across major industries the coronavirus crisis is changing the status quo.

And right now, one of our mega trends — artificial intelligence — is going to give the auto insurance industry an America 2.0 upgrade.

This is creating a new vehicle for us to profit from the AI revolution. And I have the best way for you to buy into it now before it soars and takes the auto insurance industry to new highs.

How Artificial Intelligence Is Transforming Car Insurance

We interact with artificial intelligence every day.

Every time we send an email, post to social media, use mobile banking, stream music or shop online … some form of AI is part of that transaction.

Over time, we have become accustomed to it. It’s now second nature and integral in our daily lives.

And the massive insurance industry will fully embrace AI over the coming years.

According to the Insurance Information Institute, there are nearly 6,000 insurance companies in the U.S.

Overall, the U.S. insurance industry net premiums written totaled $1.2 trillion in 2018.

It’s a big industry. And it’s on the brink of big changes.

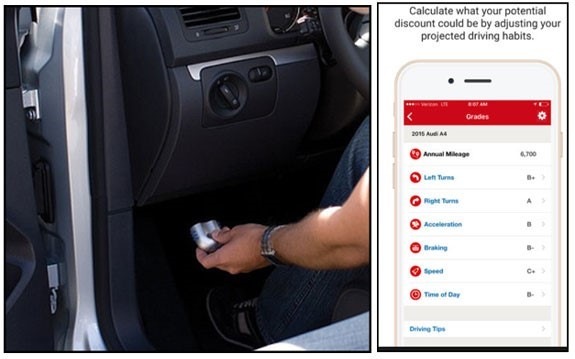

Already, many insurance companies use monitoring devices to learn about your driving habits.

These devices are small plug-ins that connect to your vehicle. They capture and score your driving habits.

Ultimately, they’re created to reward good driving behavior.

After a set amount of monitored driving time, usually 90 days, good driving behavior translates into lower insurance rates. And, of course, the opposite is true if the device captures poor driving habits.

But soon, the insurance industry is set to move beyond these devices.

Editor's Note: to see how, click here to keep reading. But see below for an amazing America 2.0 opportunity.

My No. 1 Stock For 2020

Paul Mampilly is a Wall Street legend.

(Barron’s crowned his hedge fund as the “world’s best” and Kiplinger ranked it in the top 1%.)

But a few years ago, he left Wall Street.

“I just grew tired of helping the rich get richer,” Paul explains. “So I started sharing my No. 1 investment picks with Main Street Americans.”

And his No. 1 stock picks have been phenomenal.

In 2016, Paul’s No. 1 pick — Tableau Software — shot up 199%.

In 2017, Paul’s No. 1 pick — Foundation Medicine — shot up 524%.

In 2018, Paul’s No. 1 pick — Roku — shot up 393%.

In 2019, Paul’s No. 1 pick — MTech Acquisitions — shot up 332%.

But Paul believes his No. 1 stock pick for 2020 could go even higher.

And the reason why is causing quite the stir.

“It’s a $10 stock that could climb in the days ahead,” he says during a recent interview. “It’s a company that will help the Dow to 100,000.”

Yes, you read that right.

He said: “Dow 100,000.”

If you think that sounds extreme, you’re not alone.

The host of the interview doubted Paul’s prediction, despite knowing that Paul correctly predicted every major market turn over the last two decades.

Then Paul did the unthinkable.

He showed the host one chart … a chart so powerful it silenced his critics.