This story was originally published here.

I'm looking for the bottom in stocks as hard as you are. Unfortunately, we're not there – yet.

I say this because mom-and-pop America is “buying the dip.” And this is not good news.

Think of it a bit like a game of poker… “If you don't know who the patsy is at the poker table, you're the patsy.” (Legendary investor Warren Buffett likes to say this, but I assume the saying is older than Buffett.)

In short, when you see an inexperienced player show up at a poker table, you know you're about to take his money. It's just the way the game goes.

It's only a matter of time before he loses it all – because, well, he doesn't know what he doesn't know…

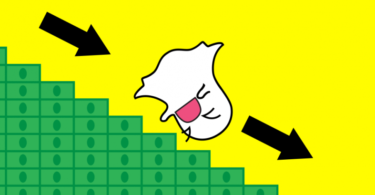

Inexperienced investors are in the same boat… They don't know what they don't know. So typically, when a big stock market fall hits the mainstream news, they appear out of nowhere to “buy the dip.” Unfortunately, it rarely ends well.

I bring this up because I'm seeing this type of behavior right now from inexperienced investors…

This Bloomberg headline from last week tells you everything you need to know: “In Midst of Chaos, Nasdaq ETF Gets Biggest Inflow in Two Decades.”

The article was written a few days ago. Since then, this month's inflows into the Nasdaq exchange-traded fund (“ETF”) are now at an all-time high.

The three previous records for monthly inflows into the Nasdaq ETF were back in 2000 – as the dot-com bubble was crashing. The months were October, November, and December 2000, to be exact.

The most likely buyers back then were individual investors “buying the dip.” And by those final months of 2000, that “dip” in the Nasdaq had landed at around 3,000 points – down 40% from the peak.

Those investors got hammered going forward…

The Nasdaq hit a couple other major lows after they bought… in April 2001 and September 2001. The ultimate bottom didn't arrive until October 2002. If they bought around 3,000 points and sold at the bottom, then they lost more than half their money.

Today, inexperienced investors are buying. So, based on history, I believe the bottom is not in yet.

If you have followed my writing over the last decade or more, you know that I am an optimist… I am always looking for the opportunity – somewhere.

I'm also a realist… I try to call 'em like I see 'em.

The optimist in me says that – someday – stocks will soar far higher than they were at the start of this year.

The realist in me says that we still have more room on the downside right now, as inexperienced investors get hurt the worst.

I'm not a buyer… yet. Now is the time to be patient.

Man who predicted GM fall identifies next big bankruptcy

No one believed Porter Stansberry years ago when he said the world's largest mortgage bankers (Fannie Mae and Freddie Mac) would soon go bankrupt.

And no one believed him when he said GM would fall apart… or that the same would happen to General Growth Properties (America's biggest mall owner)… or that oil would fall from over $100 per barrel to less than $40 a barrel.

But in each case, that's exactly what happened.

And now, Stansberry says something new and even bigger is quietly unfolding in America (watch his video clip here):

In short: A terrifying new trend is creating thousands of new millionaires (Barron's estimates 20,000 to 200,000 so far) while at the same time destroying the financial future for many others.

Porter Stansberry

Stansberry says this new trend is going to cause tens of millions of people to lose their jobs… it will also cause many major bankruptcies… yet at the same time it will make millions of others, incredibly rich.

Don't get left behind. Get the facts for yourself here.

Porter Stansberry went on camera for 10 minutes from his corporate headquarters to explain the full story. You can watch it free of charge here…