Many hedge fund managers have been burned by investor redemptions since the last few months of 2018, but even though performance has improved dramatically this year, investors continue to claw back capital from funds. In fact, redemptions are overshadowing the performance-based gains recorded by some funds, although the first quarter saw a steep decline in redemptions compared to the fourth quarter.

Performance Is Back, but Redemptions Continue

The Eurekahedge Hedge Fund Index gained 1.06% in March and 4.36% for the first quarter, which was the strongest first quarter for the industry since the Global Financial Crisis. The global equity market was off and running again, and hedge fund managers just barely trailed the MSCI AC World Index’s 1.09% gain for March. Most managers reported positive gains in March, although the month also saw redemptions throughout.

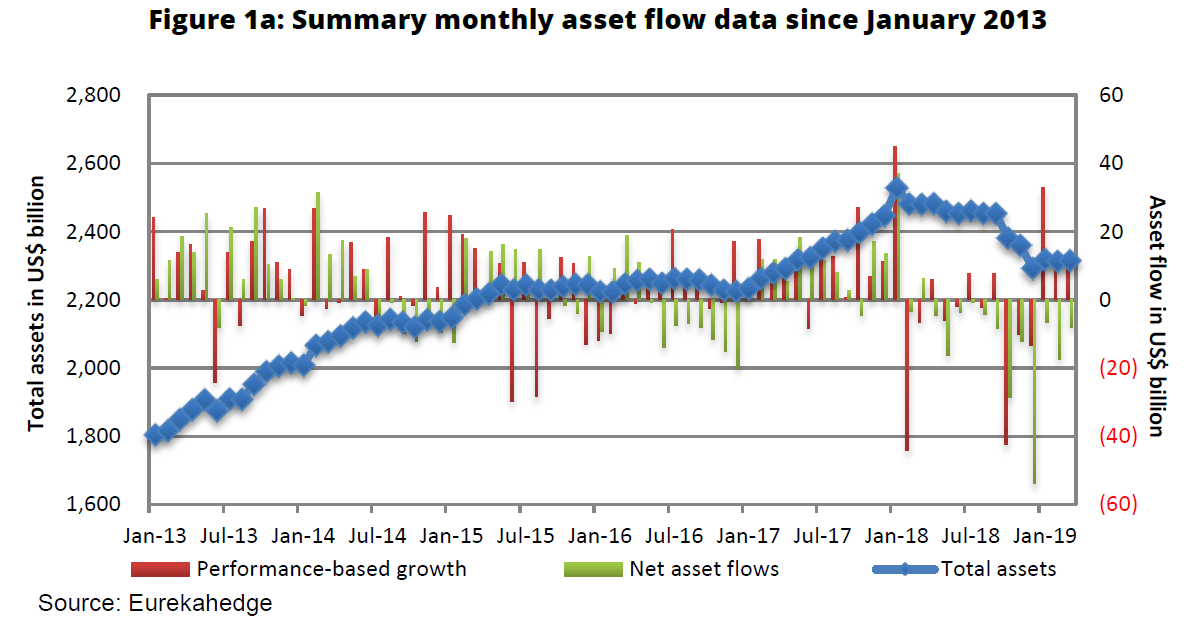

Preliminary numbers for March show $9.8 billion in performance-based gains and $8 billion in investor redemptions. The final February data reveals $12.4 billion in performance-driven gains and $17.5 billion of investor outflows. Through the end of March, assets under management by the global hedge fund industry were up about 1% for the year at $2.315 trillion. The industry shed 6.3% of its assets in 2018.

Although investor outflows are still significant, the publication added that redemption pressures have eased with a 65.9% quarter-over-quarter decline in redemptions. Year to date, the hedge fund industry has racked up $55 billion in performance-based growth and $32.3 billion in investor outflows. In the fourth quarter, redemptions totaled $94.7 billion. So far this year about half the hedge fund managers Eurekahedge tracks have already regained the losses they racked up in all of last year.

North America Was Hit Hardest

Both equities and bonds rallied in the first three months of the year, driven by dovish commentary from major central banks and optimism about the ongoing trade talks between the U.S. and China.

Eurekahedge found that North America had both the highest performance-based gains and investor outflows at S$7.1 billion and $4.4 billion, respectively. Year to date, North American funds have racked up $38.1 billion in performance-driven gains and $18.2 billion in redemptions. It was a similar story with European funds, although to much lesser extent. European fund managers saw performance-driven gains of $1.5 billion and $2.8 billion in investor redemptions.