This story was originally published here.

As the coronavirus from China spreads, there have been a handful of stocks that have performed well. Costco (NASDAQ:COST) hasn’t rallied like some, but it’s held up much better than most. That relative strength, combined with its high-quality business, makes Costco stock a name to take a closer look at.

Shares are about 12% off the February high. That slightly lags a retailer like Walmart (NYSE:WMT), which is down about 10.5% from its highs. It’s slightly better than Kroger (NYSE:KR), which is about 15.5% off its highs.

However, the difference here is that Kroger and Walmart hit those high this month, as investors flock to these so-called coronavirus buys.

Buy Grocers or Buy Costco Stock?

There’s a mixed feeling about these types of plays. On the one hand, companies like Walmart and Kroger cannot keep their shelves stocked fast enough amid widespread panic buying. This isn’t a situation of investors profiting and taking advantage of a pandemic. It’s simply matter of fact.

If you saw that Target (NYSE:TGT) couldn’t keep its shelves stocked or Ford (NYSE:F) couldn’t keep its lots full because demand was through the roof, the stocks are a buy in most investors’ minds.

It’s not as if Costco’s shelves are stuffed full of inventory — it’s as depleted as anyone else. But Costco doesn’t make a bulk of its money on sales. Instead, it’s on memberships.

There’s a pro and a con for that model. The con is that, during times like these, Costco likely will not see the type of earnings explosion that other retailers will. The pro is that it should face less volatility, in addition to a meaningful increase in revenue and earnings.

Shares have been relatively steady despite the recent decline. Keep in mind, the S&P 500 is down about 35% from its highs, so Costco stock dropping just 12% is pretty impressive.

Comparatively, Kroger and Walmart have seen plenty of volatility over the past few weeks. For instance, Walmart stock fell 15.5% from $120 to $101.55, before rallying 25.5% to new highs near $127.50.

Costco’s Got the Growth

We’re currently enduring a heavy dose of volatility and short-term pain. It’s not often that a bear market comes roaring to life so quickly. But with Costco, the company’s business model offers shelter.

Editor's Note: To continue reading, click here. But this could be an even bigger opportunity than Costco…

5G Smart Antennas Popping Up All Over America

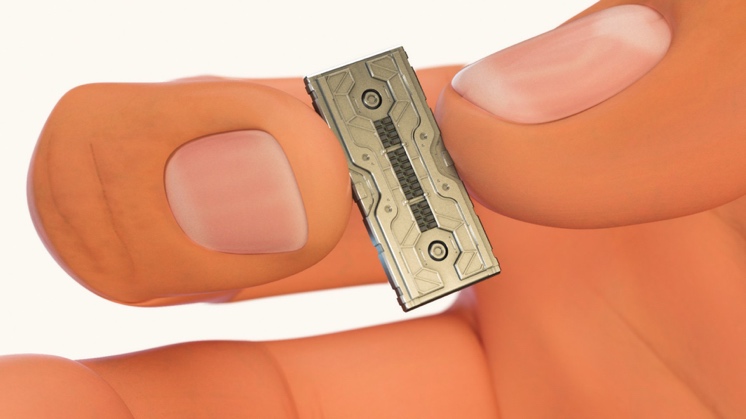

Take a peek at this shiny device…

You can squeeze it between your fingers, just like a cigarette.

It’s tiny, less than 1 inch wide by one-quarter inch tall…

But for reasons you’re about to discover…

If you place an informed “bet” on this “smart antenna” technology right NOW… it could fast-track your way to achieving millionaire status over time.

You see, this tiny device is a key enabler of 5G — the fifth generation of wireless technology now taking America by storm.

It’s inside all those strange new towers going up all over your town.

But here’s the story almost no one is talking about…

ONE company in particular is leading the charge during this exciting time.

Go HERE to discover details about my #1 tech superstar pick for 2020.

Here’s why I’m so excited about this opportunity… Past extraordinary examples from my track record have exploded by as much as 3,972%… 12,815%… 24,221%… or 50,662% over time. This makes me believe that this stock could do the same.

Use this special link for readers to see if this smart antenna opportunity could be a retirement saver for you.