The current U.S. economic expansion is now the second longest in history. While the next recession may not be imminent, at some point one will happen.

So let's take a look at how to prepare your portfolio for a recession, including what specific sectors and asset classes hold up best for retirees concerned with safe and stable sources of income.

Three Major Asset Classes to Consider

Most investors spread their portfolios across three types of major asset classes: cash, bonds, and stocks. Each group has its own strengths and weaknesses, both over the long term and during recessions and bear markets.

Cash and cash equivalents (such as savings accounts and short-term U.S. treasury bills) are a way of ensuring short-term liquidity so you have sufficient cash on hand to cover upcoming expenses.

While these investments offer little in terms of yield or capital appreciation potential (and are poor inflation hedges), they can serve a useful role in terms of providing risk-free places to preserve assets you'll definitely need in the near future.

Bonds are the second lowest risk asset class and are usually a very dependable source of fixed income during recessions. The downside to most bonds is that they offer no inflation protection (because interest payments are fixed) and their value can be highly volatile depending on prevailing interest rates.

However, the reason that financial advisors usually recommend older investors own at least some bonds is because they tend to be less correlated with so-called “risk assets” such as stocks. In fact, bonds can provide a good buffer for one's portfolio during a downturn.

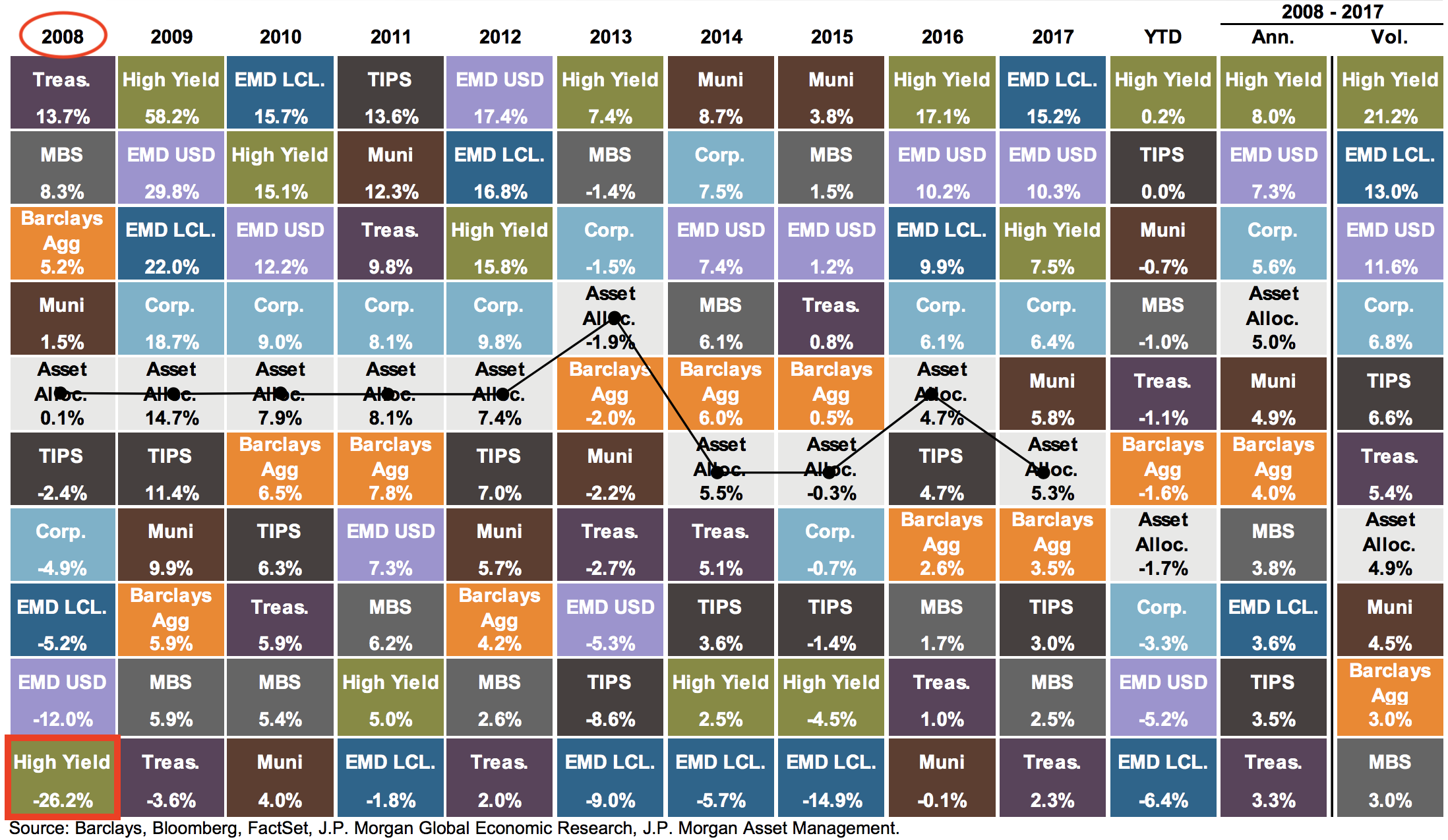

For example, according to MFS Investments, global bonds rose 12% during the 2008 and gained 8% in the 2000-2002 tech crash. However, as you can see in the fixed income performance table below, not all bonds are created equal.

In 2008, high yield bonds plunged 26.2% and emerging market debt lost 12% while Treasuries gained 13.7%. Those losses are still much better than the S&P 500's return of -37% in 2008, but risk averse investors attracted to the lower volatility of bonds still need to be selective with their purchases.

Two main factors support the solid overall performance of bonds during recessions.

First, bonds, especially government bonds, are considered safe haven assets (U.S. bonds are thought of as “risk free”) with very low default risk. Thus during recessions and bear markets for stocks, investors tend to shift money into lower risk assets which drives up their price.

The second reason bonds often perform well during a recession is that interest rates and inflation tend to fall to low levels as the economy contracts, reducing the risk of inflation eating away at the buying power of your fixed interest payments. In addition, when interest rates fall bond prices tend to rise. That's because newer bonds are issued at lower yields, so the inherent value of existing bonds also increases to match the market's current conditions.

Finally we come to stocks, which are ownership stakes in companies. Compared to bonds, stocks offer advantages in terms of superior long-term total returns, inflation protection, and income generation (many offer higher dividend yields than bonds and grow their payouts over time). The downside is that they are “risk assets” that generally fall out of favor during a recession and can swing wildly in value over the short term.

However, while it may seem intuitive that investors preparing for a recession should consider overweighting in cash and bonds, there is one potentially important reason to continue owning stocks no matter your age.

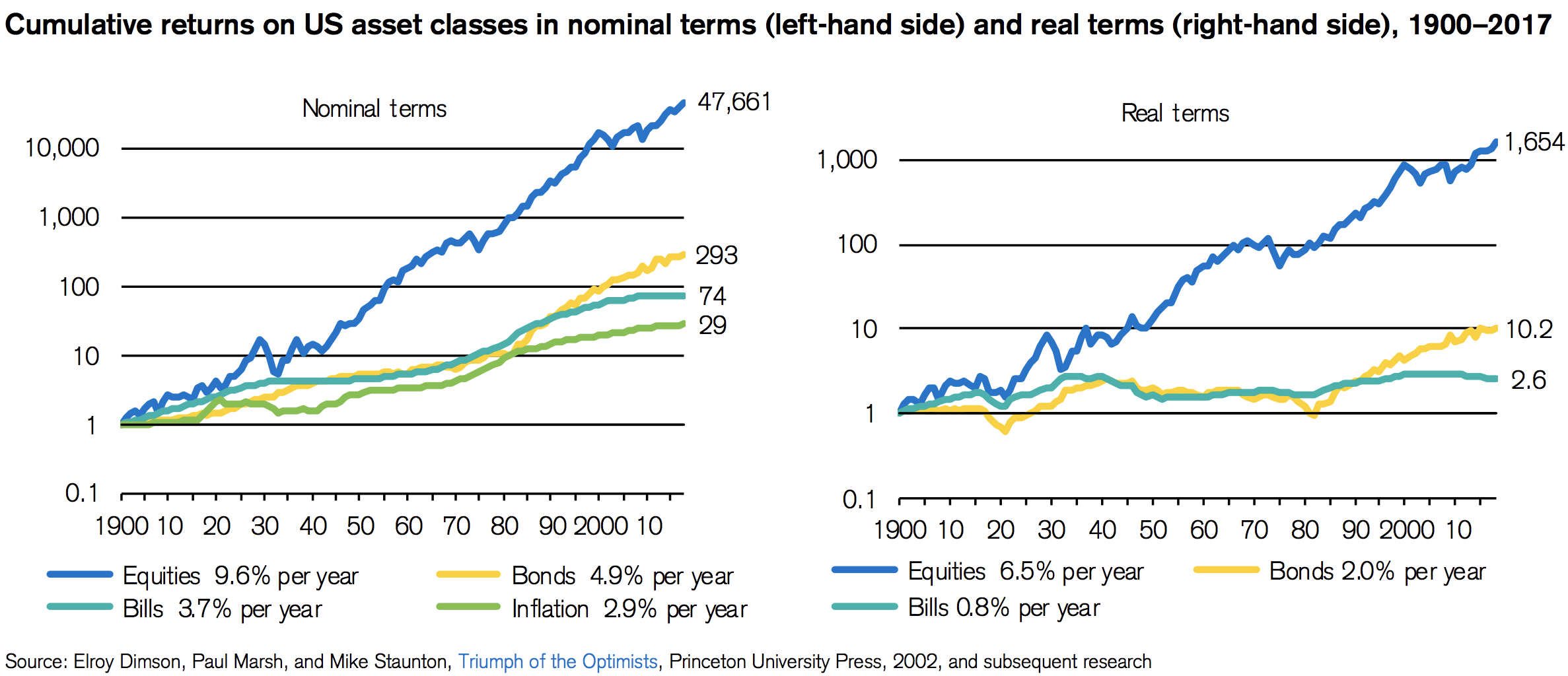

Specifically, since 1900 stocks have been the best performing asset class in terms of both absolute total returns and, importantly, inflation-adjusted total returns.

Unless your retirement portfolio is unusually large, most investors still need the compounding power of stocks working for them to ensure they don't run out of money during retirement.

Let's take a look at what kind of stocks investors should own in order to minimize their risks during a recession.

What Stocks Perform the Best During Recessions

There are three key ways that investors can go about “recession proofing” the stock portion of their portfolios. The first is to invest in stocks that have historically generated lower than average volatility but superior total returns compared to the broader market.

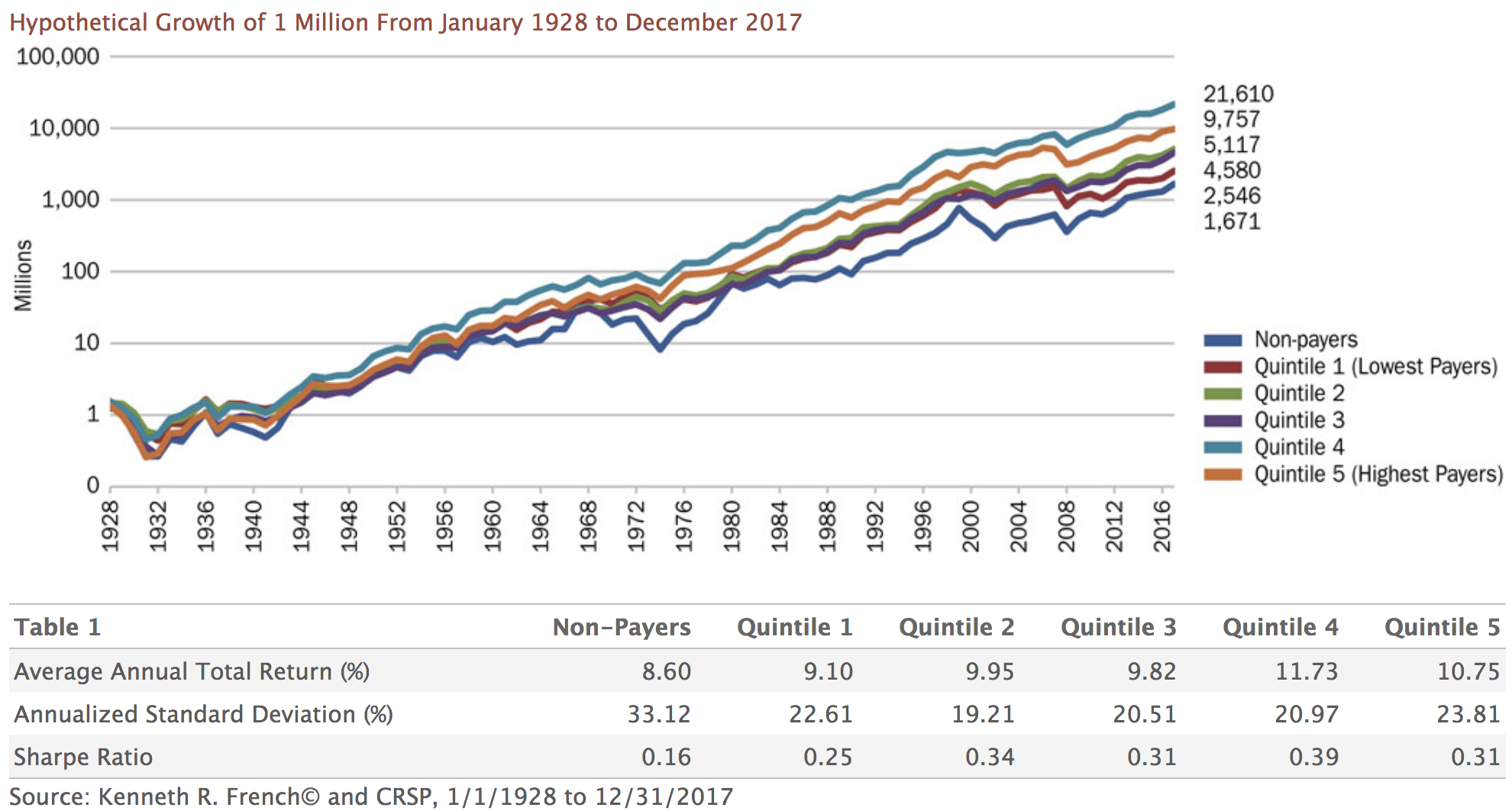

High-yielding dividend growth stocks have historically proven to be one of the best performing asset classes been far less volatile. For example, between 1928 and 2017, a time period that includes the Great Depression and two other 50+% market crashes, the 40% highest yielding stocks in the S&P 500 generated total returns of approximately 11.2% annually (see Quintiles 4 and 5 below).

More importantly for conservative investors, they did this while enjoying over 30% less volatility (lower standard deviation) than stocks that did not pay a dividend. As a result, their risk-adjusted returns, as measured by the sharpe ratio, were far superior over this period.

The second way to recession proof your stock portfolio is to focus on blue chip dividend growth stocks, such as dividend aristocrats. Aristocrats are S&P 500 companies that have increased their dividends for at least 25 consecutive years and thus have demonstrated their ability to maintain stable business models, strong balance sheets, and conservative corporate cultures.

Due to their resilient qualities, the aristocrats actually managed to generate positive returns during the 2000-2002 bear market in stocks and fell just 22% in 2008, compared to a 37% decline in the S&P 500. This shows the power of investing in safe dividend growth blue chips during troubled economic times.

More broadly, dividend-paying stocks have consistently recorded significantly less volatility than non-dividend payers over the course of many decades. The chart below plots the trailing annualized 3-year standard deviation (volatility) of each group. You can see that the blue line, which represents dividend payers, was lower than the gray line (non-dividend payers) almost every year since 1927.

Since dividends tend to be much more stable than earnings and stock prices, they help create a more stable foundation for total returns.

A final way you can lower your recession risk beyond just focusing on quality dividend growth stocks is to consider tilting your stock portfolio towards defensive sectors. Defensive sectors are those whose business models are the least affected by a recession, because they provide essential goods and services that consumers continue to buy even during a downturn.

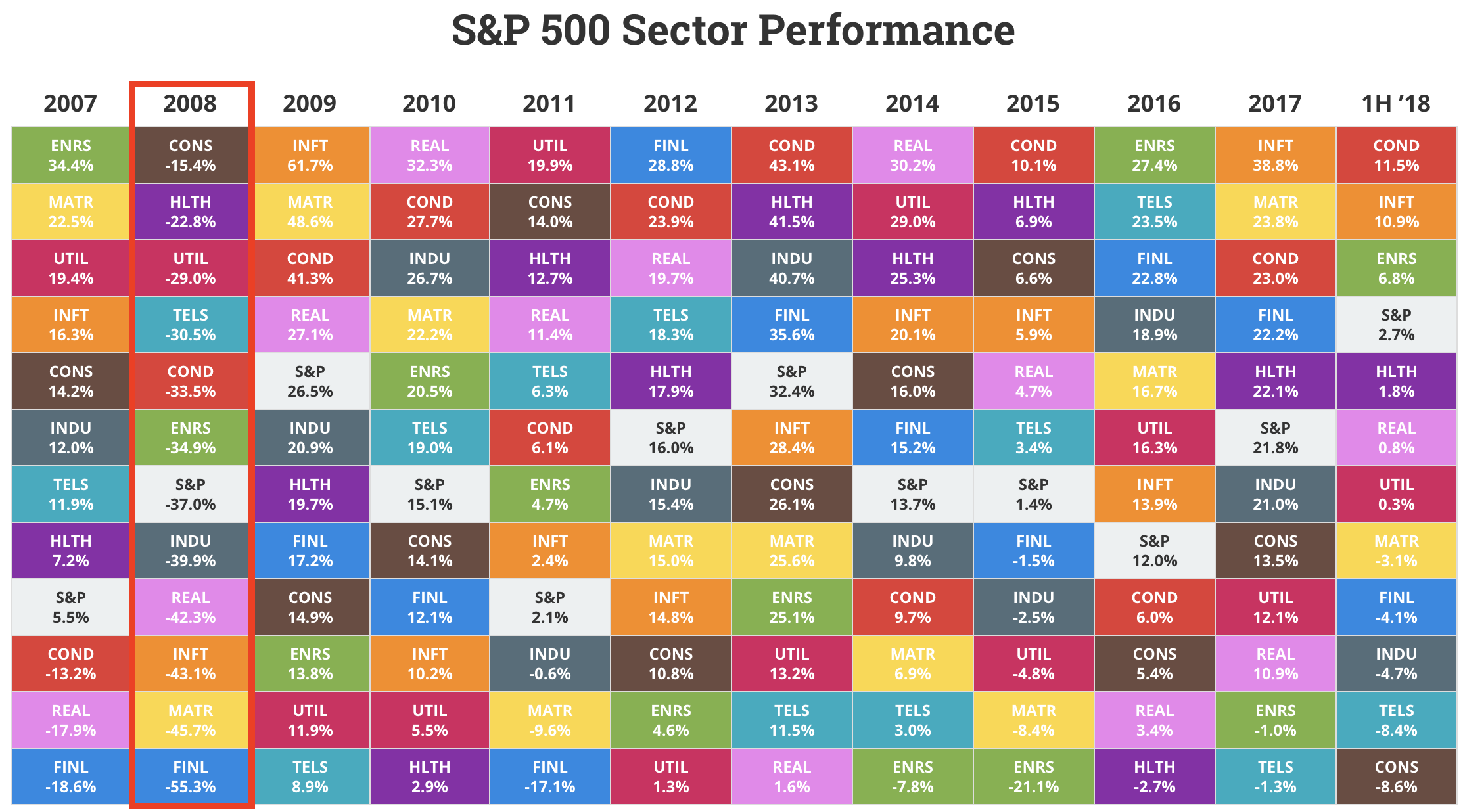

Historically speaking, consumer staples, healthcare, utilities, and telecoms have been the most recession proof sectors. Their sales are very little affected by the state of the economy since they sell essential products and services such as food, electricity, wireless internet, and medicine.

And as you can see, in 2008 these sectors, while still suffering declines, fell far less than the S&P 500.

Investors concerned with capital preservation can tilt their equity portfolios towards these more defensive areas of the market. However, our preference is to invest no more than 25% of our portfolio in any one sector to remain reasonably diversified. You never know what sector will perform the best (or worst) over any period of time.

So now that we know the basics of what assets we can own to help recession proof our portfolio, including the importance of remaining invested in quality dividend growth stocks for the long term, how does one go about building a recession proof retirement portfolio?

How to Prepare Your Retirement Portfolio for a Recession

Everyone's individual needs are different, so it's often useful to consult a certified, fee-based financial planner to construct a personalized asset allocation that's right for you.

A critical part of the process is selecting the right combination of cash, bonds, and stocks to hold that will maximize the chances of meeting your long-term financial needs. With that said, there are a few broad rules of thumb that self-directed investors can look at to prepare for a recession.

The first thing to know is how frequently recessions happen and how bad they tend to be. A 2016 study by the St. Louis Federal Reserve showed that since World War II (WWII) there is no statistically significant correlation between the duration of an expansion and short-term recession risk.

In other words, expansions don't necessarily die of old age. Some external shock usually has to trigger them. The other important thing to note is that since WWII recessions have typically been mild and short lived.

For example, in the modern era (since 1990) recessions have usually lasted under a year and seen GDP fall by less than 1.5%. The Financial Crisis, which froze vital credit markets and caused the most severe recession since 1945 was also unusually long at 18 months.

So while no one can predict when the next recession will occur, the good news is that they don't happen often, and when they do the economy tends to start bouncing back within a fairly reasonable amount of time. The key is to remain calm and stay the course.

But what about bear markets, which almost always accompany recessions?

Including the Great Depression, since 1926 the U.S. has had 10 bear markets (a 20% or more decline from the previous market high). The average duration was 24 months and the average stock market decline was 45%, per J.P. Morgan Asset Management.

Fortunately, stocks tend to recover quickly with the average time to return to all-time highs after a correction (a 10% or more decline from the previous market high) being just 10 months.

Bear markets tend to last a bit longer in terms of recovery periods. But according to a 2016 study by Moon Capital Management, since WWII the market has usually regained all-time highs within 15 months (median recovery time).

Note that more severe bear markets such as the 50% tech crash and the 57% Financial Crisis drawdown take longer, with stocks taking 55 and 65 months, respectively to regain record highs after bottoming.

Not surprisingly, many financial advisors wisely recommend that retirees hold

two to three years of living expenses in cash to help get through more severe market environments without needing to liquidate assets at the bottom.

Regardless, the major concern retirees or investors nearing retirement have is that a sharp bear market that strikes early in retirement will result in drastically reduced income under the traditional “4% rule” retirement strategy.

This is why it's important for retirement portfolios to be structured in such a way as to allow you to sleep well at night and avoid making costly financial mistakes such as panic selling at the bottom. Proper asset allocation (your mix of stocks, bonds, and cash) can help you stay the course.

Specifically, maintaining the right mix of assets can both minimize your unrealized losses during a bear market (avoid panic selling) and help ensure you have adequate financial resources to cover living expenses. As a result, you can be in a better position to remain calm and avoid selling quality stocks at depressed prices.

For example, a portfolio of 40% stocks (S&P 500 Index fund) and 60% bonds (also index funds) would have suffered a 14.9% decline in 2008 compared to a 37% decline in the S&P 500.

This is a classic retirement portfolio that benefits from the wealth building power of stocks but is still heavily focused on preserving existing wealth and minimizing volatility during recessions and bear markets.

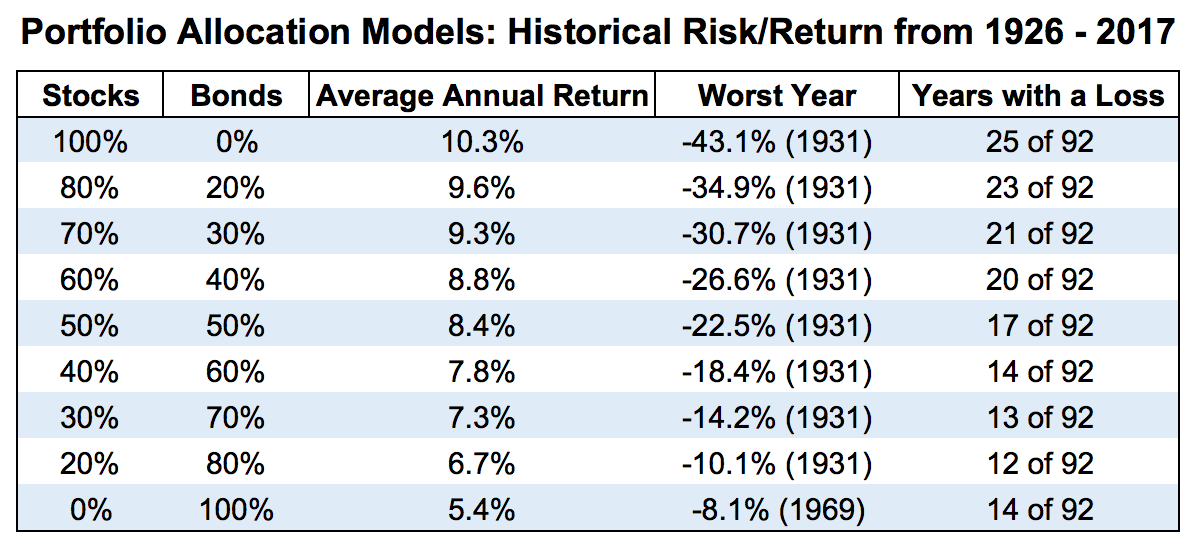

Here's a look at the historical risk/return profiles of different portfolio allocation models from 1926 through 2017. Portfolios with heavier allocations to stocks achieve much stronger annual returns, but investors must also be able to stomach larger drawdowns and more years with a loss.

Generally speaking, financial advisors recommend tailoring your asset allocation by age, meaning younger investors with longer time horizons should be more heavily invested in stocks, and older investors more invested in bonds and cash.

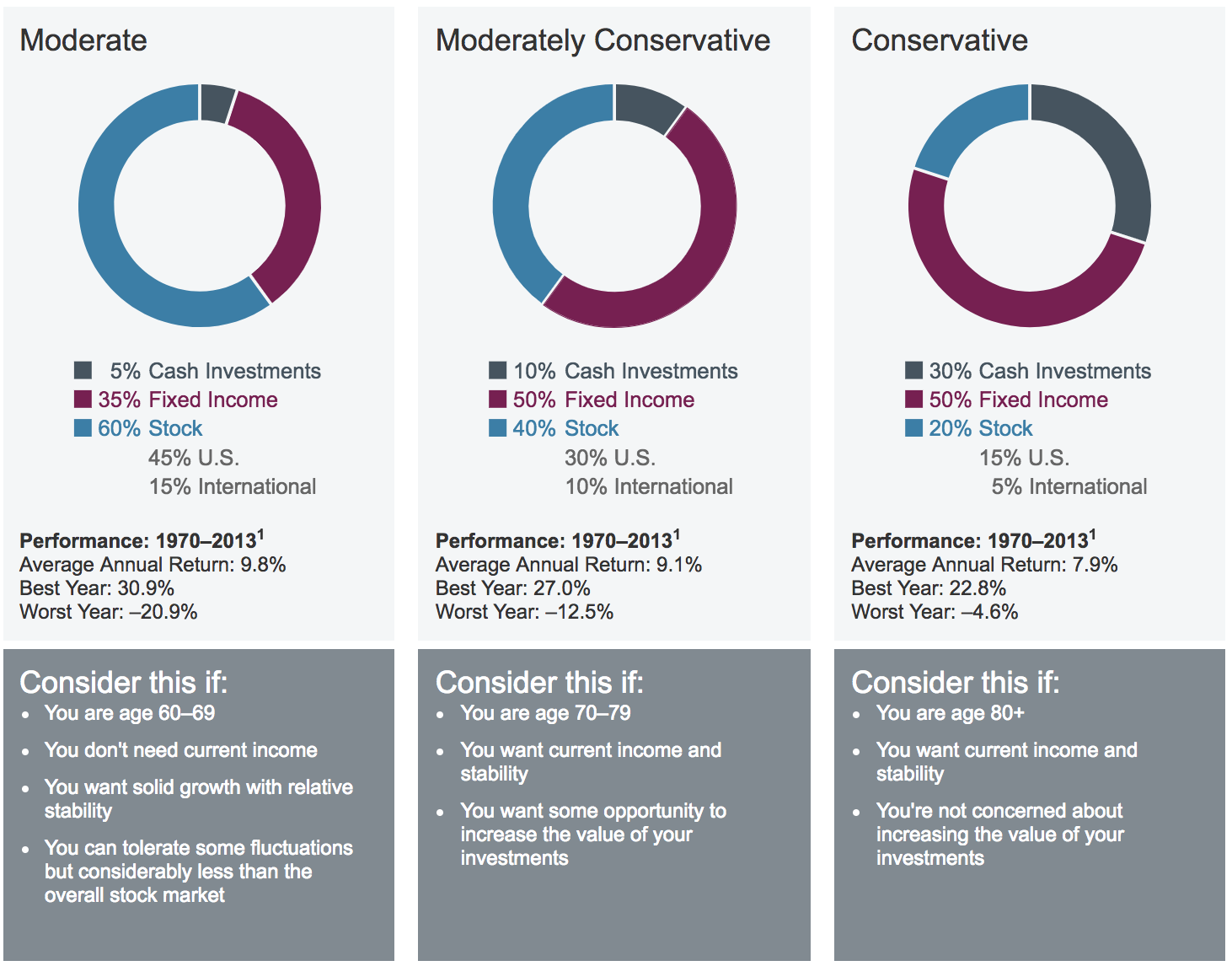

Here are three model retirement portfolios created by Charles Schwab that provide a potentially useful template for what conservative portfolio asset allocation by age might look like.

As you can see, even for conservative and retired investors Schwab recommends owning 20% to 40% stocks because their stronger long-term return profile can ensure you continue generating enough growth to overcome income or capital gains withdrawals (you minimize the risk of running out of money).

Meanwhile, the 10% to 30% cash allocation recommended for conservative retirees is designed to allow you to cover living expenses without selling stocks while the market is depressed or recovering from a low.

For younger investors (those under 60), you can be more heavily invested in stocks, since you have sufficient time for your portfolio to recover from any future bear market. But again, your individual needs will vary with your personal financial situation and risk tolerance.

Closing Thoughts on Recession Proofing a Portfolio

Recessions and bear markets are an unpleasant but inevitable part of economic and stock market cycles. Given the unpredictable timing and magnitude of these usually short-lived events, investors should not attempt to shift around their portfolios in anticipation of what could happen next.

Instead, with proper knowledge of market history and an asset allocation that's tailored to your individual needs, time horizon, and risk profile, you can help minimize your risks during economic and market downturns.

Cash and bonds can play a useful role in helping to smooth out the stock market's wild periodic swings to help you stay the course. However, since stocks are the best performing asset class over the long term, it's important for equities to make up a meaningful portion of almost all retirement portfolios.

Originally published on SimplySafeDividends.com