With nothing more than a passing glance at the headlines it's easy to conclude AT&T (T) simply dropped the ball during the first quarter of the year. Sales as well as cash flow fell short of estimates, and although it managed to continue adding mobile subscribers, the pace of that growth is slowing. Share prices tumbled nearly 11% following the release of the Q1 report last Thursday, marking the stock's biggest single-day setback in several years.

With the dust of the knee-jerk reaction starting to settle, though, a handful of encouraging details are coming to light. Here's a rundown of three overlooked reasons you may want to consider stepping into AT&T stock while it's beaten down.

1. The earnings dip comes with a major footnote

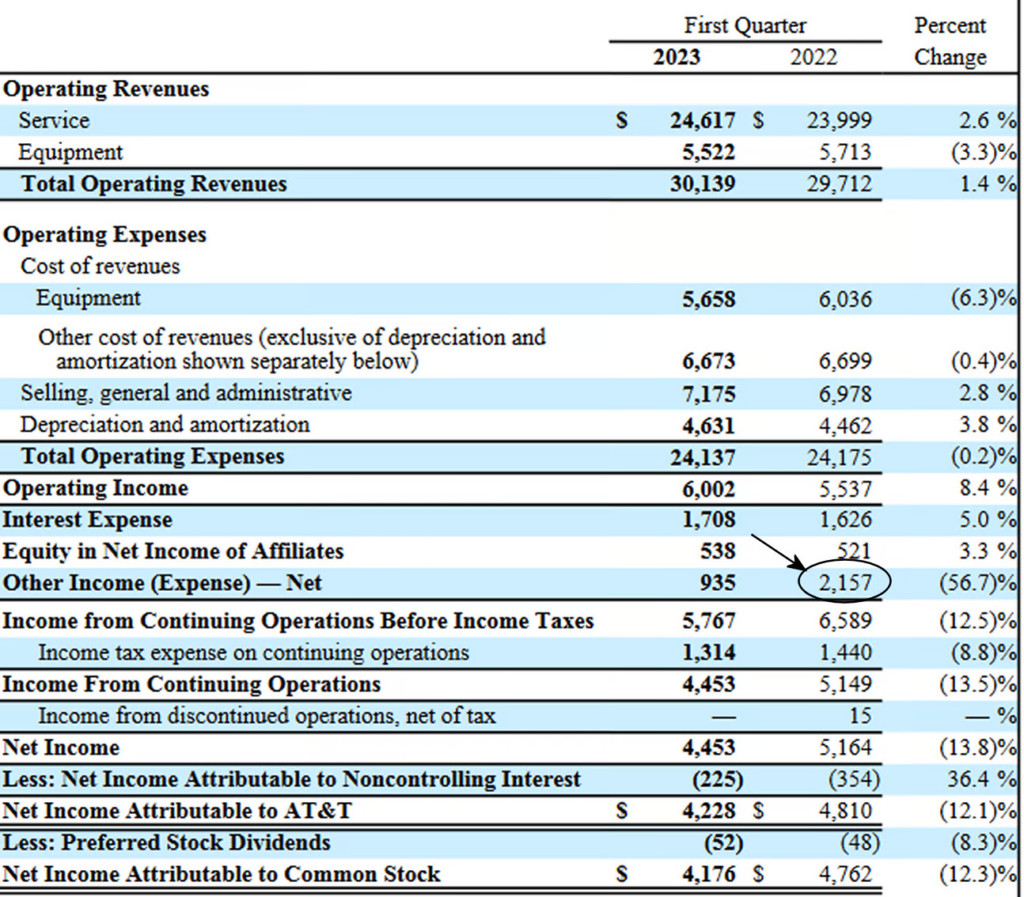

Yes, per-share profits slipped from $0.65 in the first quarter of 2022 to $0.58 per share this time around. The company's overall net income correspondingly fell 12.3%, from $4.76 billion a year earlier to only $4.17 billion during the first quarter of this year.

Take a closer look at last quarter's income statement, though. During the first quarter of 2022, AT&T booked a big $2.16 billion boost (linked to the amortization of its partial sale of DirecTV) to operating income that made for a much tougher comparison.

Were it not for that temporary fiscal benefit, actual net income would have likely grown relative to last year's bottom line. Ditto for per-share profits.

2. The subscriber-growth bar was set (very) high

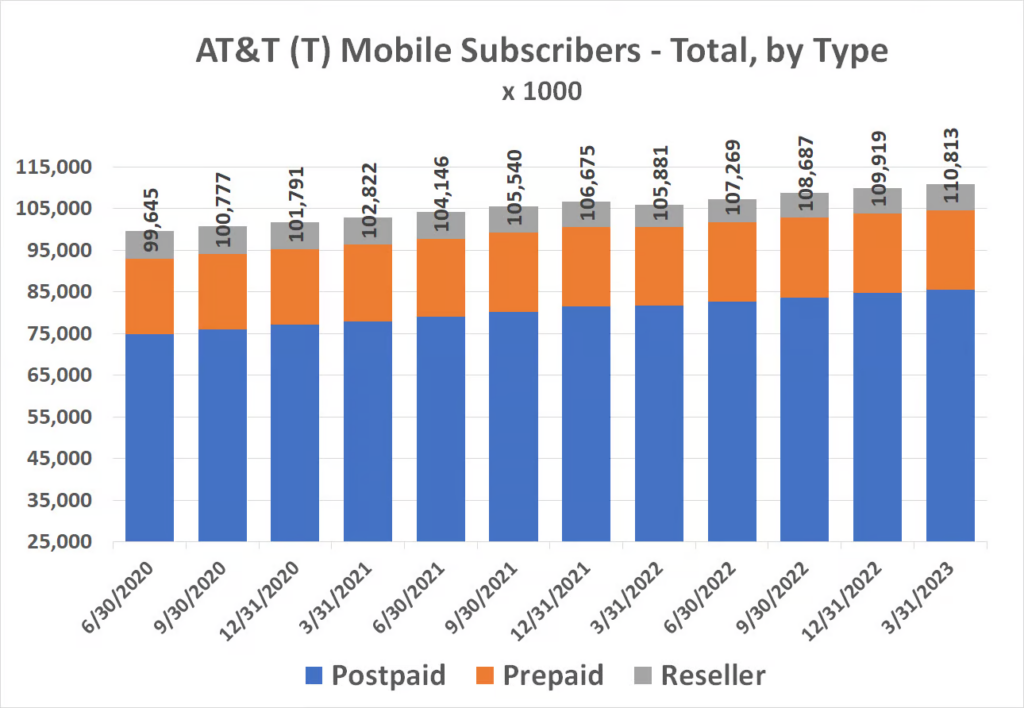

Sure, AT&T's addition of 424,000 postpaid phone customers was the slowest subscriber growth in several quarters. But let's keep things in perspective. The company's added over 6 million phones to its network over the course of the prior two calendar years.

In a market where 97% of adults already own a mobile phone (according to data from Pew Research), any growth above and beyond mere population growth is impressive.

This may help underscore just how well AT&T is doing: AT&T rival Verizon Communications lost 127,000 postpaid phone customers last quarter, and only added 201,000 such subscribers in the entirety of last year. AT&T is clearly doing something right in a tough telecom market.

3. Costs are coming down and will continue to do so

Last but not least (although it was largely overshadowed by other chatter), AT&T's operating expenses peeled back by a fraction of a percent, while revenue improved a slightly better 1.4% year over year.

That's not exactly game-changing. But that's only a taste of what's to come. As CEO John Stankey explained during the first-quarter earnings call, “[W]e believe we can further accelerate cost take-outs as we progress through the year. Part of this entails transforming our network as we ultimately replace our copper services footprint with best-in-class fiber connectivity.” He continued, “[I]n addition to all of fiber's enhanced resiliency and its superior transport characteristics, we're already seeing that fiber uses less energy, costs less to maintain and requires fewer service dispatches.”

“[A]s we reduce our copper services footprint and related legacy infrastructure,” he concluded, “we expect to consistently improve our margins, grow EBITDA, and ultimately improve our capital efficiency.”

In the meantime, AT&T aims to wrap up a different $6 billion cost-cutting initiative by the end of this year.

You could certainly do worse than AT&T

Is AT&T stock a perfect pick? No, AT&T's still got plenty to figure out. Cash flow is lackluster, and it's sitting on $123.7 billion worth of long-term debt it's got no apparent plan to address anytime soon. This debt cost the company $1.7 billion in interest payments last quarter alone.

But priced at only 7 times this year's projected earnings — and paying a well-protected dividend that's more than 6% of the stock's present price — this telecom name may be worth scooping up now. The market's pricing in a lot of baggage linked to DirecTV, Warner Media, and its legacy infrastructure that's no longer weighing the company down.

Originally published on Fool.com

James Brumley has positions in AT&T. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.