Inertia is a powerful force – and if you’re like most Americans – you’re still earning almost nothing on your cash because if it.

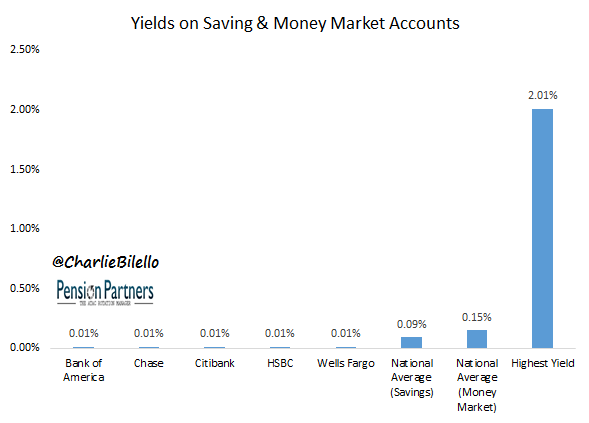

According to Bankrate.com, the national average yield on savings and money market accounts are currently 0.09% and 0.15% respectively. Many of the largest banks (Bank of America, Chase, Citibank, HSBC, and Wells Fargo) are offering even less: 0.01%.

What is the top savings rate offered today with FDIC Insurance? For the first time since 2008, it’s over 2%…

For your cash in investment accounts, Prime Money Market Mutual Funds are fast approaching 2% as well…

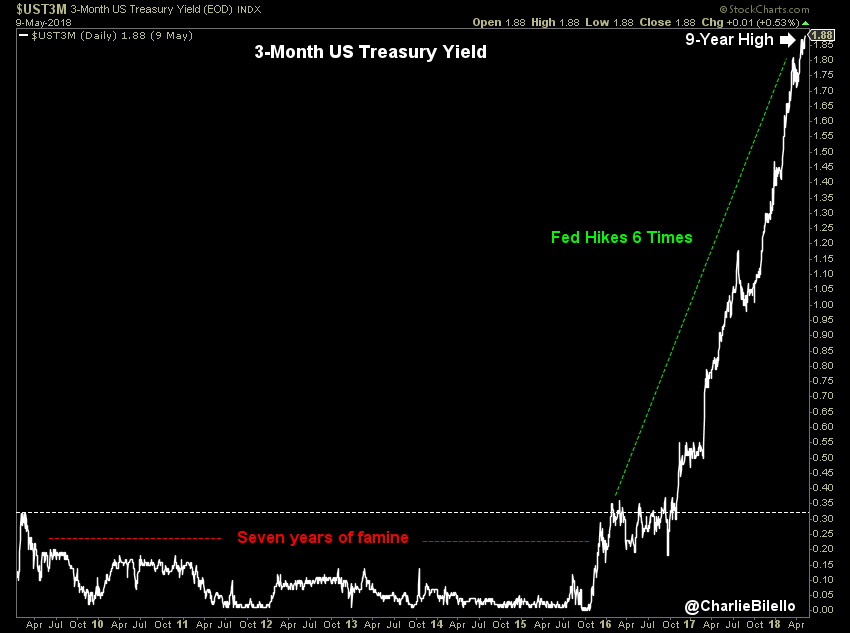

Why are yields moving higher? The Federal Reserve controls short-term interest rates, and at long last they are moving toward a more normal monetary policy. Since December 2015 they have hiked interest rates by 0.25% on 6 separate occasions and are expected to hike rates at least 2 more times before the end of this year.

So why would anyone still accept 0.01% when they could be earning 2.01%?