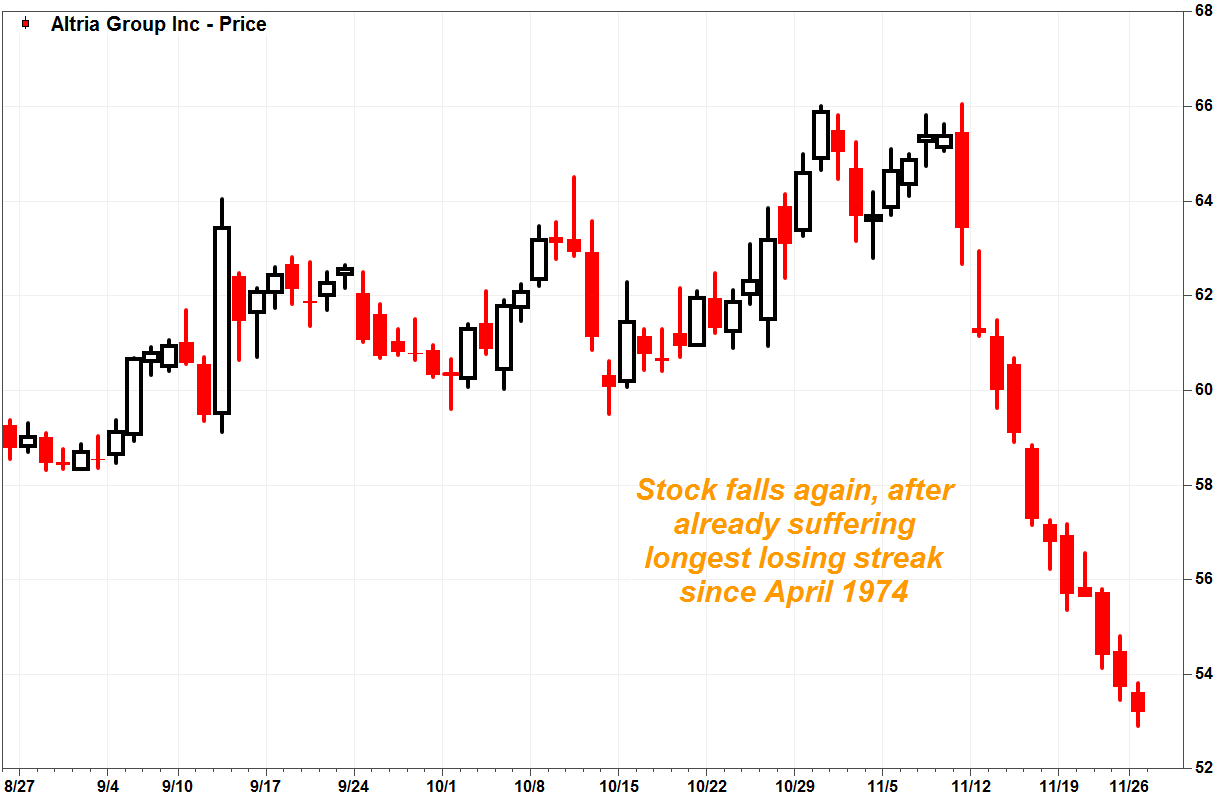

Shares of cigarette manufacturer Altria Group Inc. have suffered their longest losing streak in at least 48 years — enough to cause Wells Fargo analyst Bonnie Herzog to “pound the table” in urging long-time-horizon investors to buy.

The stock MO, +1.16% fell 1.0% Monday, to stretch its losing streak to 11 sessions. That is the longest losing streak since data are available, going back to Jan. 2, 1970, according to Yahoo Finance.

The stock has plunged 18.6% during its losing streak. That’s the worst performance over an 11-day stretch since it plummeted 20.8% during the 11-days through Nov. 20, 2008.

“The recent pressure on [Altria’s] stock price and valuation has been nothing short of remarkable,” Herzog wrote in a note to clients.

- Industry cigarette volumes are not as bad as feared based on feedback from retailer contacts in Wells Fargo’s “Tobacco Talk” survey. The survey suggested cigarette volumes were down 3.5% in October, while Nielsen suggested volumes were down 8.2%.

- The Food and Drug Administration’s recent decision to restrict e-cigarette flavors and pursue menthol cigarette/cigar bans may be “broadly concerning,” but it doesn’t materially impact near-term trends. Herzog said, importantly, the e-cigarette flavor regulations could actually benefit Altria on a relative basis, since e-cigarette maker Juul has the most to lose.

- Altria’s valuation is “very attractive,” Herzog said, with the stock price’s multiple over fiscal 2019 earnings per share at a five-year low. And if there is a silver lining to the stock’s recent slide, it’s that it has lifted the implied dividend yield to 6.02%, currently making it the ninth highest yielding stock in the S&P 500.

“As such, we see limited downside risk in the stock from here and encourage [long-term] investors to step up and buy the stock,” Herzog wrote, especially ahead of a few potential near-term positive catalysts.

Those potential catalysts include Nielsen’s biweekly data — the next release is scheduled for Tuesday — could show improving cigarette volume trends, based on feedback from Wells Fargo’s retail contacts, lower gas prices, which historically have benefited cigarette volumes, and the FDA’s premarket tobacco applications (PMTA) approval of lower-risk, heat-not-burn tobacco heating system IQOS.

how do buy the stocks