This story was originally published here.

No sector was spared in the bloodbath on Wall Street yesterday.

Technology was hit the hardest, but every other component of the S&P 500 Index declined with it.

Don’t assume we’re headed even lower just now … this could be a one-off adjustment gone haywire after options traders got crushed. The algorithms kicked in, as they always do, and turned it into a rout.

The formula that’s kept this bull market alive is still in place: Thanks to the Federal Reserve, there is no alternative to stocks.

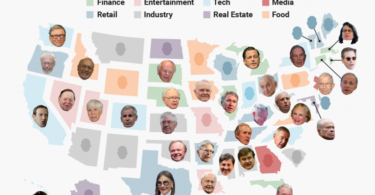

But that same formula has created a “bear market for humans,” as a leading Wall Street analyst put it this week.

I illustrated the same point in a YouTube video, weeks before that Bloomberg report.

The companies doing best in this year’s stock market are those that have little need for human labor. The valuations of firms that rely on actual people to make money, meanwhile, have plunged.

It’s no time to panic sell when you see a sell-off such as yesterday’s. But in today’s video, I’ll show you the charts that prove there are momentous changes in store for the stock market down the road … watch to find out what they are.

Editor's Note: Click here to keep reading and watch the video.

The No. 1 Tech Stock of 2020 Just Tripped a Rare “BUY” Signal

Dear Reader,

One company is about to blow nearly every other tech firm out of the water.

As one investment analyst commented: “Its numbers are truly mind-blowing.”

Thirty-one analysts recently gave this stock a massive buy/outperform rating…

And it just triggered a fresh signal that indicates it could be about to explode in price.

You see, this company holds more than 200 patents, and 500 more are pending in a technology that experts are calling “the new oil.”

That makes this company absolutely dominant in a tech revolution that is expected to explode 18,767%.

You won’t want to miss this.

Click here now to see exactly why Ian King recommends this amazing company.

Sincerely,

Jessica Cohn

Editorial Director, Banyan Hill Publishing