This story was originally published here.

Shares of personalized styling service Stitch Fix (NASDAQ:SFIX) have plunged over the past few weeks on concerns that the novel coronavirus outbreak — which is now undergoing community spread in the United States — will materially slow the U.S. economy and Stitch Fix’s business. From its mid-February highs, Stitch Fix stock has dropped more than 20%.

These concerns are overstated and this sell-off is overdone. Stitch Fix will not be materially impacted by the coronavirus, which is today and projects to remain a relatively small outbreak in the U.S.

The only material thing that will come of the coronavirus in the U.S. is some social distancing for a few months. Such social distancing could actually be a good thing for Stitch Fix. If anything, it will push consumers more towards online shopping platforms and services like Stitch Fix. In this light, Stitch Fix shouldn’t be down on coronavirus concerns.

At the same time, the company’s long-term fundamentals are very strong, near-term trends are improving, and there’s reason to believe that the stock will rebound with significant velocity once coronavirus fears pass, which they will.

All things considered, then, my two cents is simple: buy the dip in Stitch Fix.

Coronavirus Fears are Overstated

In general, the economic impacts of coronavirus are being overstated, and with respect to Stitch Fix, they are being grossly overstated.

The novel coronavirus outbreak is a big, scary, and volatile thing. But it’s just an epidemic, and like all other epidemics before it, this too shall pass.

Ignore the media headlines. They get more clicks and more money when they act like this is the apocalypse. Instead, look at the data. China was the epicenter of the outbreak, which started in December. Back in early February, that country was reporting thousands of new cases per day. For the past few weeks, that rate has dropped to well below 500 new cases per day. In recent days, the figure has hovered around 150 new cases per day.

In other words, the outbreak has essentially died in China. That means in about two months, China leveraged strict quarantining to essentially “beat” the coronavirus outbreak.

The U.S. and other countries are following similar strict quarantining procedures. They will also get some major help from warmer weather in March and April. It’s reasonable to assume, then, that the outbreak globally will be put to rest by late April or early May. Compare Brokers

Until then, the only things likely to happen at scale in the U.S. are some social distancing, a few cancelled events, more hand-washing, and less travel. The only implication of those things for Stitch Fix is a positive one. Social distancing will keep people from malls, and push them more towards online shopping platforms and services like Stitch Fix.

SFIX Stock Will Rebound

The 20% sell-off in Stitch Fix stock on overstated coronavirus concerns is an opportunity. Not just because the sell-off is overdone, but also because the fundamentals support a huge rally to new highs.

At its very core, Stitch Fix is a curation service. That’s hugely valuable. We live in a world where curation is becoming exceptionally useful. Thanks to the internet, consumers have a world’s worth of information, content, and choices at their finger tips. They don’t have enough time to sift through all of that stuff. Curation is increasingly turning into a necessary tool which connects the right things to the right people.

In the retail world, the benefits of curation are very obvious. Thanks to e-commerce, consumers have an infinite number of apparel options at their finger tips. There isn’t enough time in a day for those consumers to go through all those options. So, Stitch Fix provides a service which curates apparel options for consumers, thereby making the shopping process easier, more efficient, and more convenient.

Because of this, I think Stitch Fix can continue to gain mainstream traction over the next several years as a go-to curated styling service. Sure, not everyone will be able to afford Stitch Fix. But those who can will likely pay up for it, because curation is a huge benefit in today’s world.

Assuming this to be true, then Stitch Fix has huge long-term growth potential. Stitch Fix’s sales are projected to rise by more than 20% this year. Yet, sales will come in under $2 billion. The U.S. and UK apparel and footwear markets project to measure north of $500 billion by 2023. The huge delta between Stitch Fix’s present sales base and its market opportunity implies that 20%-plus revenue growth rates are here to stay for a lot longer.

If they are, then sustained huge growth will power Stitch Fix stock higher.

Bottom Line

Stitch Fix stock is an undervalued long-term winner that has been unfairly punished by overstated coronavirus concerns. As such, I think the investment thesis here is shockingly simple. Buy Stitch Fix stock on any and all coronavirus-related dips. Accumulate a position in this winner at discounted prices. Let curation and online shopping tailwinds power the stock to huge gains over the next few years.

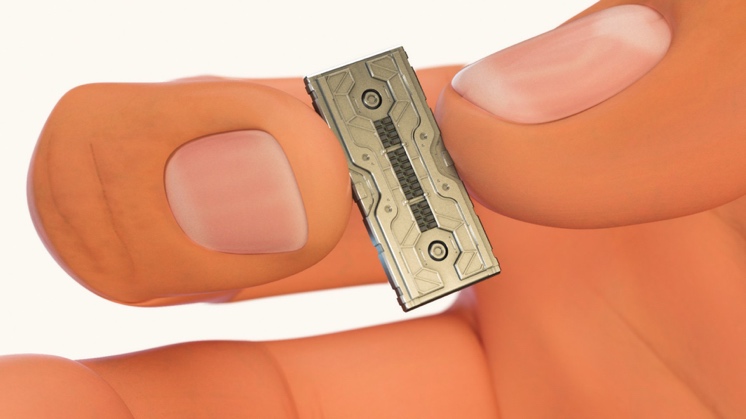

Editor's Note: Take a peek at this shiny device…

You can squeeze it between your fingers, just like a cigarette.

It’s tiny, less than 1 inch wide by one-quarter inch tall…

But for reasons you’re about to discover…

If you place an informed “bet” on this “smart antenna” technology right NOW… it could fast-track your way to achieving millionaire status over time.

You see, this tiny device is a key enabler of 5G — the fifth generation of wireless technology now taking America by storm.

It’s inside all those strange new towers going up all over your town.

But here’s the story almost no one is talking about…

ONE company in particular is leading the charge during this exciting time.

Go HERE to discover details about my #1 tech superstar pick for 2020.

Here’s why I’m so excited about this opportunity… Past extraordinary examples from my track record have exploded by as much as 3,972%… 12,815%… 24,221%… or 50,662% over time. This makes me believe that this stock could do the same.

Use this special link I’ve set up for InvestorPlace readers to see if this smart antenna opportunity could be a retirement saver for you.