The market was up 22% over the course of the past year, led by giants like Amazon.com, Inc. (NASDAQ:AMZN) and Facebook Inc. (NASDAQ:FB), before the bottom finally fell out and investors’ fears for a correction materialized.

When the market pulls back again, not every stock necessarily has to make the trip lower. There are plenty of off-the-radar, highly compelling names from the small-cap realm that may well shrug off a market downturn and do their own thing.

Which stocks, you ask?

There are several out there, but they might be difficult to find because of their diminutive size. If you’d rather not start that search on your own, here’s a look at ten small-cap stocks to buy. These small caps are not sure things, but they bring as much reward potential to the table as risk.

As with all risky investments, these high-risk stocks to buy have to be kept on a short leash and require plenty of monitoring. But considering their potential, they could be well worth the time and effort.

High-Risk Small-Cap Stocks to Buy Now: Axon Enterprise Inc (AAXN)

Year-to-date gain: 60%

Axon Enterprise Inc (NASDAQ:AAXN) is anything but a household name. For military and police personnel, however, Axon is a familiar maker of TASER guns, body cameras and a few more related accessories. In fact, the company used to be called TASER International.

Last year wasn’t an easy year for Axon. Between losing a body camera contract it arguably should have won with the NYPD, a nasty patent dispute with Digital Ally and the SEC questioning its revenue-booking procedure, the bears had plenty of fodder to work with.

This year could be, and should be, quite different though. Aside from putting all the aforementioned headaches in the past, its relatively young Evidence.com venture — which helps law enforcement better manage digital evidence — is a recurring revenue machine that’s starting to get some serious traction. Recurring revenue evens out the inherent swings of selling long-cycle hardware like stun guns and body cameras to organizations that require bureaucratic approval.

High-Risk Small-Cap Stocks to Buy Now: Innoviva Inc (INVA)

YTD gain: 2.2%

Innoviva Inc (NASDAQ:INVA) wouldn’t be anywhere without GlaxoSmithKline plc (ADR) (NYSE:GSK). The two companies work hand-in-hand to make and market inhaled drugs like Anoro and the combination drug Relvar/Breo. Both of these therapies are delivered through Innoviva’s Ellipta device and treat respiratory problems asthma and COPD.

While Innoviva may seem reliant on medicines made by Glaxo, Glaxo is no less dependent on Innoviva’s delivery system. Even the FDA approvals are for the combination of the drugs and the device together.

And neither company is eager to leave the arrangement.

Even with royalty rates that are only a small fraction of either drug’s sales, Innoviva’s revenue grew an estimated 63% in 2017.

This year’s projected sales growth of 32% keeps INVA at the top of a short list of small-cap stocks to buy sooner than later.

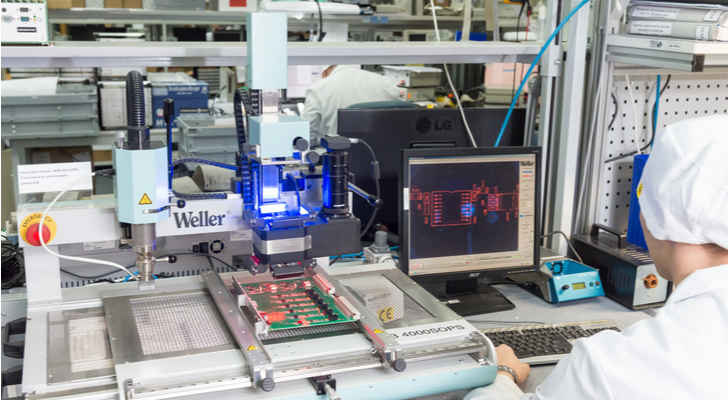

High-Risk Small-Cap Stocks to Buy Now: Axcelis Technologies Inc (ACLS)

YTD gain: -23%

Axcelis Technologies Inc (NASDAQ:ACLS) isn’t so much a semiconductor company as it is an outfit that serves semiconductor manufacturers. It makes a variety of equipment used by chip companies — equipment like its Purion Ion Implanter — so its future is more or less the same as that of chip makers.

And the pros think that future is a bright one. After growing the top line an estimated 50% last year, analysts are collectively looking for 11% growth in 2018. That doesn’t sound like a lot, but bear in mind that the outlooks for the economic boom following recent tax cuts are strong. And these cuts could prove stunningly supportive for small cap stocks.

With an average price target of $34.40, analysts say this small cap stock is undervalued to the tune of 32%.

High-Risk Small-Cap Stocks to Buy Now: Craft Brew Alliance Inc (BREW)

YTD gain: 0.8%

Contrary to popular belief, the global craft beer movement isn’t a fad that’s run its course. It’s just matured. We won’t see the booming growth rates of yesteryear, but as of the middle of last year the annual revenue growth rates for the industry had leveled off at 5%.

Enter Craft Brew Alliance Inc (NASDAQ:BREW), one of the more mature players positioned to make the most of the market. Last year’s 3.6% increase in revenue should only marginally improve to 5.7% this year. But, that’s not the point.

That modest revenue growth should be enough to push Craft Brew Alliance well into the black. The per-share profit of 5 cents in 2016 is expected to grow to 14 cents for 2017 and move on to 33 cents per share for 2018. Most traders just aren’t watching and won’t see it coming.

High-Risk Small-Cap Stocks to Buy Now: Crocs, Inc. (CROX)

YTD gain: 23%

Crocs, Inc. (NASDAQ:CROX). If the name rings a bell, there’s a reason — this company was all the rage a decade ago when its hyper-comfortable shoes were discovered by consumers in search of foot-based bliss. The euphoria eventually died down, and Crocs has almost fallen off investors’ — as well as consumers’ — radars.

Like many other fashion trends though, the goofy-looking foam shoes never died; they just went away for a while. Now they’re back with a vengeance. The shoes recently showed up on fashion show runways flaunting designs from Christopher Kane and Balenciaga.

After that, things could get really interesting. Stifel Nicolaus analyst Jim Duffy recently upgraded Crocs, explaining:

“In combination with growth opportunities in Europe, China, and Korea, we have more confidence in 2018 revenue potential. With evidence of brand relevance and more deliberate communication of SG&A reduction objectives, we expect increased appreciation for 2019 earnings potential as the year unfolds and believe shares outperform.”

Better still, Crocs is on pace to swing back to a profit for 2017, and catapult its bottom line to a profit of an estimated 30 cents per share this year.

High-Risk Small-Cap Stocks to Buy Now: AeroVironment, Inc. (AVAV)

YTD gain: -0.2%

Drone mania isn’t exactly new, but we’ve only scratched the surface of how these flying tools can be utilized to make life better and easier. They don’t have to just be military hardware.

That’s something AeroVironment, Inc. (NASDAQ:AVAV) knows quite well . Though AeroVironment is best known for supplying flying hardware for the military, it’s making new headway in the civilian market too.

Last month AeroVironment unveiled a $16,5000 autonomous drone that analyzes crops and ultimately improves crop yield. And that’s just a microcosm of the mainstreaming of drones.

Once institutional-level organizations realize what all a drone can do (aside from farming), AeroVironment is perfectly-positioned to capitalize on the opportunity.

YTD gain: -6.4%

The cord-cutting movement is not only undeniable, it’s accelerating. In 2016, the cable television industry lost 1.7 million customers, but gave up 2.6 million subscribers in 2017 as over-the-top alternatives and over-the-air options improve.

But there’s a problem: Switching between aerial antennas and OTTV boxes can be a pain. Plus, when cable customers give up their cable television boxes, they also give up their digital video recorders.

Enter TiVo Corp (NASDAQ:TIVO). Yes, this is the same TiVo that powers the DVR portion of some cable and satellite television receivers. It also makes a variety of air-wave receivers and over-the-top streaming boxes as well. More recently, it’s making all-in-one solutions that combine the convenience of recording, the option of airwave-delivered television and the accessibility of on-demand video services like Netflix or Hulu.

The more cord-cutting we see, the better it is for TiVo.

High-Risk Small-Cap Stocks to Buy Now: Comtech Telecomm. Corp. (CMTL)

YTD gain: 1.3%

The average investor may not fully understand what Comtech Telecomm. Corp. (NASDAQ:CMTL) makes and markets. Its technologies are used in satellite-based cellular connections, HD television broadcasting, military and law-enforcement tracking systems and more. Basically, Comtech produces a collection of technologies — like solid-state amplifiers — whose time has finally come.

A quick glance at its 2018 forecasts don’t look all that compelling.

Sales are presently expected to rise less than 3% this year. While that will drive per-share profits from 2017’s projected 45 cents to 64 cents, that’s still less than it earned in 2016. Analysts are slowly but surely upping their expectations though and may continue to do so as the year progresses. Just a month ago, for all of 2017 the pros were only expecting a bottom line of 39 cents per share.

The 2018 outlook may not yet fully reflect the earnings growth that’s likely in this unexpectedly strong economy.

High-Risk Small-Cap Stocks to Buy Now: Ligand Pharmaceuticals Inc. (LGND)

YTD gain: 14.4%

This should be a big breakout year for Ligand Pharmaceuticals Inc. (NASDAQ:LGND). Profit margins have widened to levels that make too good a value to pass up.

Ligand’s business model relies primarily on partnering with bigger players by owning the rights to either pharmaceuticals or the underlying IP needed to make them. For instance, Captisol is a chemical structure that improves the efficacy of the active ingredients in drug treatments like VFEND, from Pfizer Inc. (NYSE:PFE), and Naxafil-IV from Merck & Co., Inc. (NYSE:MRK). Amgen, Inc. (NASDAQ:AMGN) also relies on Ligand’s technology to make cancer treatment Kyprolis.

As was noted, a lot of things are likely to fall into place for Ligand this year. The pros are modeling profits of $4.27 per share in 2018, up from $2.98 for 2017. That makes LGND one of the top small cap stocks to buy within the biotech sector.

High-Risk Small-Cap Stocks to Buy Now: Quantenna Communications Inc (QTNA)

YTD gain: 7.4%

Last but not least, add Quantenna Communications Inc (NASDAQ:QTNA) to your list of small cap stocks to buy now — if you can stomach the risk.

You may be using Quantenna Communications’ technology without even realizing it. The company designs and builds Wi-Fi platforms for consumers and corporations. It’s particularly impressive in the HD video arena — a market that’s only going to heat up as the lines between telecom and video entertainment service providers are blurred. For instance, AT&T Inc. (NYSE:T) already owns DirecTv, and it’s trying to acquire Time Warner Inc (NYSE:TWX). Soon, they’re all going to be packaged together, and delivered in new — and wireless — ways.

Numbers-wise, analysts are modeling 20% revenue growth for 2018, which should be enough to drive a near-doubling of the company’s bottom line this year.

More at: InvestorPlace

Our Top Investment Pick

Have you seen one of these pop up in your neighborhood?

It’s NOT for the cell phone you carry in your pocket…

My colleague Jeff Brown just recorded a mind-blowing video about it.

I just watched it with my own eyes, and I STILL can’t believe it.

One of the big reveals was how you could use a “leak” from Washington D.C. to become up to $150,000 richer in the next 18-24 months.

In fact, his research is so darned convincing. I’ll be surprised if you don’t.

In possibly the biggest tech breakthrough of his 25-year career…

Jeff reveals how to tap a hi-tech secret bigger than Google, Amazon, and Microsoft. COMBINED.

As he says at the 15:48 mark…

“Early pioneers in this arena have enjoyed rises of 8,900%… 17,000%… 62,000%…”

And he expects this one to be even BIGGER!

Check it out right here.