Appalachian natural gas for the win

Maxx Chatsko (Antero Midstream Partners L.P.): Units of Antero Midstream Partners currently yield a healthy 5.5% with an annual distribution of $1.66 per unit. By 2022, the company expects to increase the annual distribution to $4.10 per unit, which would translate to a 13.6% yield at today's prices. Can the business deliver?

While an impressive amount of growth is required to make the math work, the midstream leader is well-positioned to make good on its plans for a major increase in distributable cash flow. First, Antero Midstream Partners generates a substantial amount of business supporting the operations of its sponsor, Antero Resources. That provides a relatively predictable stream of revenue and profits from natural gas gathering and processing services, as well as water deliveries. As the parent expands its footprint in natural gas and natural gas liquids, the midstream business will tag along for the ride.

Second, Antero Midstream Partners has leveraged its unique and valuable relationship with its parent to diversify operations — with exceptionally low costs of capital. The business hasn't paid more than 4.5 times EBITDA for growth projects in the last three years, which is half to one-third as much as most peers. That's helped to deliver profitable growth, a healthy balance sheet, and flexibility to invest in a downstream joint venture for liquids and chemicals infrastructure.

Third, operations are centered in the Appalachian region, which is responsible for 41% of domestic natural gas production and expected to double production in the next five or so years. Production growth requires infrastructure growth, and Antero Midstream Partners already operates one of the largest networks in the region. Simply put, long-term investors looking to own a piece of the American energy revolution should strongly consider this high-yield dividend stock.

Approaching 6%

Tim Green (AT&T): How does triple the dividend yield of the S&P 500 sound? That's what you get with telecom giant AT&T. The stock has been sinking since the beginning of 2017, and the result is a dividend yield of about 5.9%. AT&T's dividend isn't growing very quickly — the last increase was just 2%. But the company has raised its dividend for 34 years in a row and will likely make it 35 years in the next few months.

In addition to that sky-high dividend yield, AT&T stock is cheap relative to the bottom line. Shares trade for less than 10 times the average analyst estimate for 2018 earnings. That beaten-down valuation may reflect concerns about the amount of debt the company has taken on while building its media empire. The company acquired DirecTV in 2015 and Time Warner earlier this year. Those megadeals have pushed AT&T's total debt above $180 billion.

But AT&T's core wireless business is a cash flow machine. The company has generated nearly $20 billion of free cash flow over the past 12 months, even after pouring nearly $21 billion into capital expenditures. AT&T's scale, and the massive barrier to entry into the wireless business, give the company a competitive advantage.

The debt that AT&T has piled on in recent years makes the company more fragile. It's made AT&T a riskier dividend stock by reducing the margin for error. If the company's media bets don't pan out, or if the wireless business faces more intense competition, that dividend growth streak could come to an end. But a cheap valuation and high dividend yield make AT&T a stock worth considering, as long as you understand what could go wrong.

An energy yieldco built to last

Travis Hoium (TerraForm Power): Stocks with high dividend yields can often be sending a warning sign to investors. Relatively high yields imply that investors don't think the dividend can last long term or that there's something inherently risky in the underlying business. One high yield stock that has surprisingly strong fundamentals is TerraForm Power, one of the biggest renewable energy yieldcos in the world.

TerraForm Power owns a portfolio of over 3,600 megawatts (MW) of wind and solar assets, and 95% of energy production is contracted for an average of 14 years, ensuring the stability of long-term cash flow. Management even says it has a “clear path” to grow the dividend 5% to 8% through 2022 while paying out 80% to 85% of cash available for distribution (CAFD) as a dividend. The remaining 15% to 20% of CAFD will help fund organic acquisitions when they're available.

TerraForm Power's dividend yield of 6.5% seems high, even for a yieldco, but the new management from Brookfield Asset Management, which controls the company, is running a fairly conservative operation. They've already identified $25 million of annual cost savings and $20 million of revenue improvement from increased performance that will increase cash flows over the next year. The slow expected dividend growth and cash retained to fund growth projects will ensure the dividend remains strong long term and continues to be a winner for investors.

More at TheFool.com

The Biggest Stock Opportunity of The Year

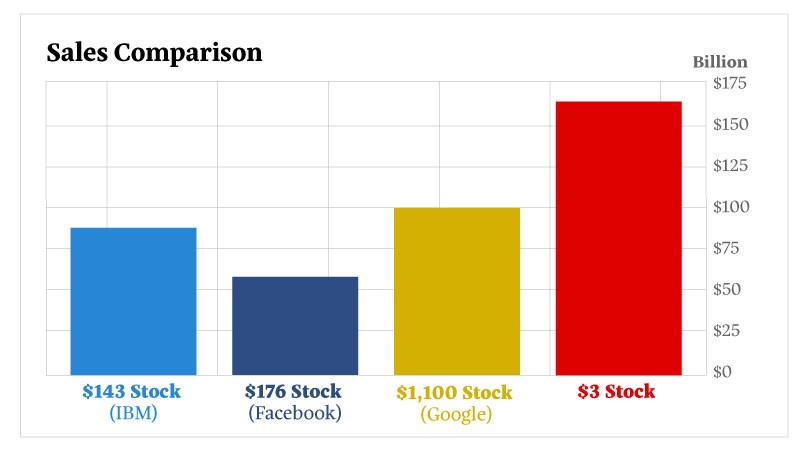

Look at the chart below.

It shows the revenue of four tech stocks. One is IBM. One is Facebook. One is Google.

And that big red one to the right?

That’s a virtually unknown stock that trades under a secret name.

It brings in more cash than any of the other three tech giants.

And yet…

While IBM trades for $143, Facebook for $176 and Google for more than $1,100…

This other company trades for just $3.

Find out why in this leaked footage from a former Wall Street money manager.

It’s mind-blowing.