This story was originally published here.

Fears over the coronavirus from China continue to play whack-a-mole with asset prices. That said, let’s focus on stocks to buy that are benefiting from the shift in consumer preferences due to the health scare.

Overall, spotting which companies are getting a boost is quite easy. All you have to do is look at the top market performers during the last month.

The S&P 500 peaked on Feb. 19th, and fell nearly 19% as of Monday’s close. By comparison, today’s picks have all risen anywhere from 7% to 19% over the same time frame.

The relative strength has allowed these beauties to keep their uptrends intact, and I see few reasons why they won’t be able to continue working higher. In addition to analyzing their price charts and offering up ideas on how to trade them, we’ll also explore the narratives that are driving buyers’ interest.

So, let’s check out these stocks to buy that are benefiting from the coronavirus.

Stocks Benefiting From the Coronavirus: Zoom Video Communications (ZM)

Performance since S&P 500 peak: +17%

Zoom Video Communications (NASDAQ:ZM) provides a video-first communication platform and web conferencing services. Its growth prospects are being supercharged as more companies are allowing their employees to work remotely due to the stigma of social gatherings.

Of course, a compelling story isn’t enough to buy a stock. Chart watchers demand price confirmation, evidence that bulls are on the move and a company’s shares are under accumulation. Fortunately, ZM stock delivers the goods. High volume up days have accompanied its uptrend and reveals big-league buyers are climbing aboard.

Its been a volatile ride, but ZM still sits atop rising 20-day and 50-day moving averages. We can reduce the cost of the currently pricey options by using options spreads. To position for a run back toward $130, consider the following trade.

The Trade: Buy the May $110/$130 bull call spread for around $6.90. Compare Brokers

Teladoc (TDOC)

Performance since S&P 500 peak: +19%

As a consumer, I love the name of Teladoc Health (NYSE:TDOC). It says it all. They offer an on-demand healthcare platform where you can literally “tell-a-doc” about whatever ails you. The coronavirus crisis has only amplified the appeal of TDOC stock. As mentioned above, the company’s shares rallied 19% while the S&P 500 cratered 19%.

From a price perspective, TDOC has one of the best trends on the Street right now. Its 20-day, 50-day and 200-day moving averages are rising steadily with momentum starting to pick-up right now. It gapped higher after last month’s earnings report even after having increased considerably over the past quarter. The response speaks volumes as to how participants feel right now about the company’s earnings growth. And therefore, it’s impossible not to have Teladoc included in our stocks to buy list.

Because of the high volatility and price tag of TDOC, bull call spreads are an appealing alternative to long stock.

The Trade: Buy the July $160/$180 bull call for around $7. Compare Brokers

Kroger (KR)

Performance since S&P 500 peak: +7%

Nothing drums up interest for consumer goods products like pandemic fears. The increased foot traffic at places like Costco (NASDAQ:COST) and Walmart (NYSE:WMT) has boosted their share prices, but they aren’t the only stores benefiting. Kroger (NYSE:KR) operates supermarkets across the United States, and has seen its share price pushing higher during the market turmoil.

The company’s recent earnings report contributed to the optimism after the company delivered better-than-expected results. Moreover, KR stock is at a two-year high and boasts a clear and consistent uptrend. While the recent outsized volatility is likely to die down, the trajectory of its trend should remain higher. As long as it holds north of the 50-day moving average near $29, bull trades are a go.

The Trade: Buy KR stock. Options traders could purchase the June $33/38 bull call spread for around $1.60.

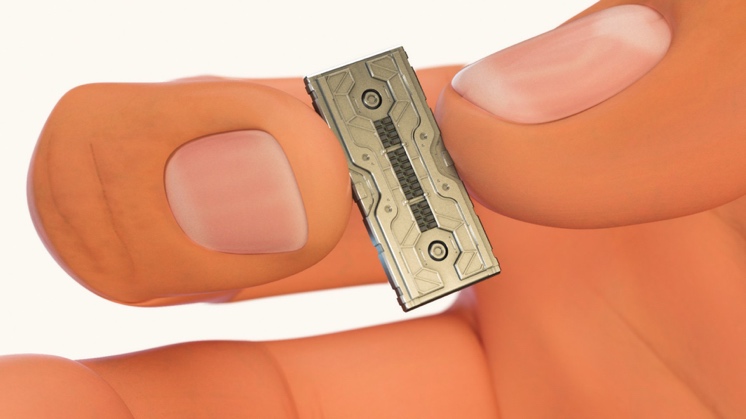

Editor's Note: Take a peek at this shiny device…

You can squeeze it between your fingers, just like a cigarette.

It’s tiny, less than 1 inch wide by one-quarter inch tall…

But for reasons you’re about to discover…

If you place an informed “bet” on this “smart antenna” technology right NOW… it could fast-track your way to achieving millionaire status over time.

You see, this tiny device is a key enabler of 5G — the fifth generation of wireless technology now taking America by storm.

It’s inside all those strange new towers going up all over your town.

But here’s the story almost no one is talking about…

ONE company in particular is leading the charge during this exciting time.

Go HERE to discover details about my #1 tech superstar pick for 2020.

Here’s why I’m so excited about this opportunity… Past extraordinary examples from my track record have exploded by as much as 3,972%… 12,815%… 24,221%… or 50,662% over time. This makes me believe that this stock could do the same.

Use this special link I’ve set up for readers to see if this smart antenna opportunity could be a retirement saver for you.